Get Ut Ustc Tc-721 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-721 online

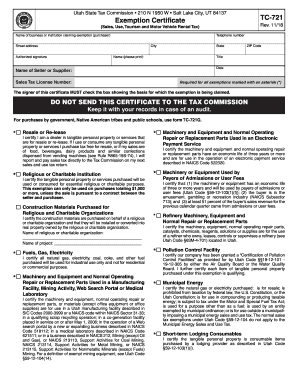

The UT USTC TC-721 is an exemption certificate that allows businesses to claim exemptions from sales, use, tourism, and motor vehicle rental tax. This guide will help you navigate the process of filling out the form online, ensuring that you understand each section and contribute to accurate completion.

Follow the steps to successfully complete the UT USTC TC-721 form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Provide the name of the business or institution claiming the exemption in the designated field. Ensure that the name is accurate and reflects the entity applying for the exemption.

- Enter the telephone number for the business or institution. This contact information is essential for any follow-up or verification.

- Fill in the street address, city, state, and ZIP code for the business or institution. Complete this section to provide your location details.

- In this field, sign the document with an authorized signature. Make sure this signature belongs to a person who has the authority to sign on behalf of the business or institution.

- Print your name clearly in the space provided right below the authorized signature. This ensures clarity about who signed the document.

- Indicate your title in the field provided to clarify your role within the organization.

- Enter the date on which the form is being filled out to document the timeframe of your claim.

- In the section corresponding to the name of the seller or supplier, provide the required seller’s information that supports the exemption claim.

- Add the sales tax license number in the header area of the form as required for all exemptions marked with an asterisk (*).

- Check the box next to the basis for which the exemption is being claimed. Carefully review the options available and select the one that fits your situation.

- Once all sections are completed, review the form for accuracy and completeness to prevent any errors.

- Save the changes made to the form. You may also choose to download, print, or share the completed form as needed, ensuring you keep a copy for your records.

Complete your UT USTC TC-721 form online today to ensure your tax exemptions are accurately documented.

Get form

Obtaining tax-exempt status in Utah involves completing an application to the Utah State Tax Commission. Your organization must meet specific criteria, such as non-profit status or educational purpose. Prepare necessary documentation that proves your qualifications to streamline the approval process. Resources like the UT USTC TC-721 can support you in understanding the requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.