Loading

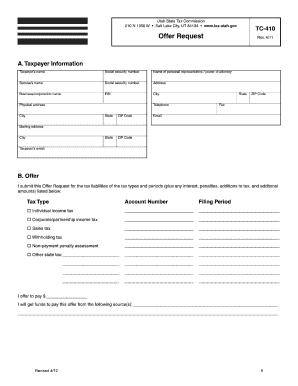

Get Ut Ustc Offer In Compromise Booklet 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC Offer in Compromise Booklet online

Filling out the UT USTC Offer in Compromise Booklet online can be a seamless process when you know the right steps. This guide will walk you through each section, providing clear and supportive instructions to help you complete the form accurately.

Follow the steps to successfully complete the Offer in Compromise Booklet.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out your personal information in the designated fields. This usually includes your name, address, and contact information. Be sure to provide accurate details to ensure smooth processing.

- Next, you will need to detail your financial situation. This may involve listing your income, expenses, and any assets you may own. Take your time to gather all necessary documentation to back up the numbers you enter.

- In this section, outline the reasons for your offer in compromise. Clearly articulate why you are unable to pay the full amount. Provide any supporting information that might strengthen your case, such as financial hardships or changes in circumstances.

- Review all entered information for accuracy. Ensure that everything is filled out completely and correctly, as any discrepancies may delay your application.

- Once you have confirmed that all details are correct, you can save your changes, download the form for your records, print a copy, or share it as needed.

Complete your documents online today for a hassle-free experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When determining your offer in compromise amount, start by evaluating your disposable income and assets. The IRS has guidelines, but offers typically range from a few thousand to tens of thousands of dollars. The UT USTC Offer in Compromise Booklet can assist you with strategies to craft a competitive and reasonable offer that reflects your financial reality.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.