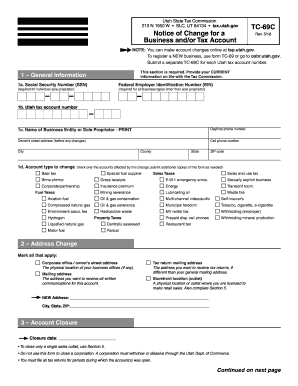

Get Ut Tc-69c 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign UT TC-69C online

How to fill out and sign UT TC-69C online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can turn into a major hurdle and a significant hassle without proper assistance.

US Legal Forms has been designed as a digital solution for UT TC-69C e-filing and presents various benefits for taxpayers.

Utilize US Legal Forms to guarantee a convenient and straightforward UT TC-69C filling experience.

- Locate the template on the website within the designated category or via the search engine.

- Click the orange button to access it and wait for the process to complete.

- Review the template closely and take note of the instructions. If this is your first time completing the sample, follow the step-by-step directions.

- Pay special attention to the highlighted fields. These are fillable and require specific details to be entered. If uncertain about what to include, refer to the instructions.

- Always ensure to sign the UT TC-69C. Utilize the integrated tool to create your e-signature.

- Click the date field to automatically input the correct date.

- Re-examine the sample to verify and revise it before submission.

- Press the Done button in the top menu once you have completed it.

- Save, download, or export the finalized template.

How to amend Get UT TC-69C 2018: personalize documents online

Place the correct document alteration tools at your disposal. Execute Get UT TC-69C 2018 with our trustworthy solution that includes editing and eSignature features.

If you aim to finalize and authenticate Get UT TC-69C 2018 online effortlessly, then our internet-based cloud option is the ideal choice. We provide a comprehensive template library of ready-to-edit forms that you can tailor and complete online. Furthermore, there’s no need to print the document or rely on external tools to make it fillable. All essential functions will be accessible for your use the moment you open the file in the editor.

Let’s explore our online editing features and their primary functions. The editor has an intuitive interface, so it won't take much time to learn how to navigate it. We’ll review three key areas that allow you to:

In addition to the features described above, you can secure your document with a password, apply a watermark, convert the document to the desired format, and much more.

Our editor simplifies the process of modifying and certifying the Get UT TC-69C 2018. It allows you to accomplish virtually anything when it involves dealing with forms. Additionally, we consistently ensure that your experience with documents is secure and adheres to major regulatory standards. All these factors make utilizing our tool even more enjoyable.

Obtain Get UT TC-69C 2018, implement the necessary edits and modifications, and download it in your preferred file format. Give it a try today!

- Alter and comment on the template

- The upper toolbar contains tools that enable you to emphasize and obscure text, without graphics and graphic elements (lines, arrows, checkmarks, etc.), sign, initialize, date the document, and more.

- Arrange your documents

- Utilize the left toolbar if you intend to reorder the document or remove pages.

- Prepare them for distribution

- If you wish to create a fillable template for others and share it, you can use the tools on the right to add various fillable fields, signatures, dates, text boxes, etc.

Get form

Related links form

To obtain a Utah sales tax number, complete the necessary online application through the state tax commission's site. The process may include submitting the UT TC-69C if it relates to your registration. Once your application is approved, you will receive your tax number, enabling your business to collect sales tax. Utilize uslegalforms for templates and resources that can simplify this step.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.