Loading

Get Ut Tc-49 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-49 online

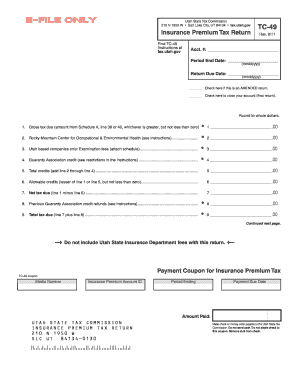

The UT TC-49 form is essential for reporting insurance premium tax returns in Utah. This guide provides clear, step-by-step instructions on how to accurately complete the form online, ensuring you meet all necessary requirements.

Follow the steps to complete the UT TC-49 form online.

- Click ‘Get Form’ button to access the UT TC-49 online form and open it in the editor.

- Fill in your account number in the designated field. This number is unique to your tax account and is required for your submission.

- Enter the period end date using the format mmddyyyy. It is crucial to ensure the date corresponds to the reporting period for the insurance premium tax.

- Provide the return due date in mmddyyyy format. This date indicates when your tax return must be submitted.

- If you are submitting an amended return, check the corresponding box to indicate this status. This notifies the tax commission that the return has been altered.

- If this is your final return, check the box that indicates you are closing your account.

- Complete the tax calculation by entering the gross tax due on line 1. This amount comes from Schedule A, line 39 or 40, whichever is greater.

- If applicable, fill in the amount for the Rocky Mountain Center for Occupational & Environmental Health on line 2.

- For Utah-based companies, include examination fees on line 3, and make sure to attach the required schedule.

- Enter any applicable Guaranty Association credit on line 4, following the restrictions outlined in the instructions.

- Add the amounts from lines 2 through 4 and enter the total on line 5.

- On line 6, indicate the allowable credits by entering the lesser amount of line 1 or line 5, ensuring it is not less than zero.

- Calculate your net tax due by subtracting line 6 from line 1, and enter that figure on line 7.

- If applicable, record any previous Guaranty Association credit refunds on line 8.

- Total your tax due on line 9 by adding line 7 and line 8.

- Continue filling out the remaining fields on page 2, including previously applied refunds and prepayments as per the instructions given.

- After completing all sections, ensure all information is accurate. You can then save your changes, download, print, or share the completed form as necessary.

Complete your UT TC-49 form online today to ensure timely submission and compliance.

Taxpayers in Utah can generally expect their refunds within 4 to 6 weeks after filing electronically, and up to 8 weeks for paper returns. Timely filings and accurate information can speed up the processing time. Understanding this timeline can help you plan your finances better. For an easy filing process, consider using Uslegalforms and the UT TC-49.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.