Get Tx Trs 6 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX TRS 6 online

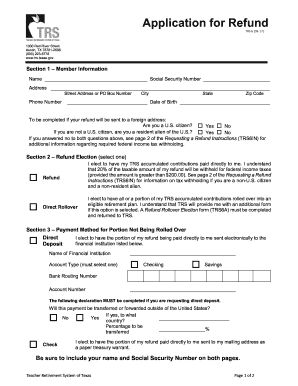

The TX TRS 6 form is essential for members of the Teacher Retirement System of Texas who wish to request a refund of their accumulated contributions. This guide provides detailed, step-by-step instructions for filling out the form online, ensuring a smooth and efficient process for users with varying levels of experience.

Follow the steps to complete the TX TRS 6 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out Section 1 – Member Information. Provide your name, Social Security Number, address, phone number, city, state, zip code, and date of birth. If your refund will be sent to a foreign address, indicate your citizenship status by selecting 'Yes' or 'No' for the respective questions.

- Proceed to Section 2 – Refund Election. Choose between receiving your TRS contributions directly or opting for a direct rollover into an eligible retirement plan. Ensure you understand the tax withholding implications related to both options by reviewing the information provided.

- In Section 3, specify your payment method for the portion not being rolled over. You can select direct deposit by providing your bank details, including the financial institution's name, account type (checking or savings), bank routing number, and account number. Alternatively, opt to receive a paper treasury warrant sent to your mailing address.

- Complete Section 4 – Waiver of Benefits and Member Certification. Read the statements carefully, agree to the terms, and provide your signature along with the date. Ensure that your signature is notarized.

- Review the entire application for accuracy, ensuring that your name and Social Security Number are included on both pages of the form.

- Submit the completed TX TRS 6 form and any required additional documents to the Teacher Retirement System of Texas by mail. Retain a copy for your records.

- Once your application is processed, you will receive a confirmation regarding your refund payment, which will be issued according to the payment method selected.

Complete your TX TRS 6 form online today for a hassle-free refund process.

Get form

Related links form

To upload documents to TX TRS 6, you need to log into your TRS account. Once logged in, navigate to the document upload section where you can easily attach the files. Make sure your documents are in the required format to ensure a smooth uploading process. If you encounter issues, consider using USLegalForms to find templates or forms that support your document preparation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.