Loading

Get Mo 812-1099 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO 812-1099 online

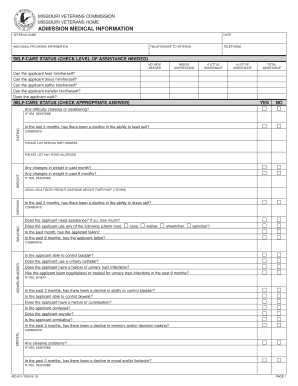

The MO 812-1099 form is an essential document for providing admission medical information concerning veterans. This guide will walk you through the step-by-step process of filling out the form online, ensuring you provide all necessary details accurately.

Follow the steps to complete the MO 812-1099 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the veteran's name at the top of the form. Ensure that the name matches official documents to avoid any issues.

- In the 'Self-care status' section, check the box that corresponds to the level of assistance the veteran requires — options include no help needed, needs supervision, a little assistance, a lot of assistance, or total assistance.

- Provide the telephone number for easy communication regarding the veteran's admission needs.

- Indicate whether the applicant has any difficulties with chewing or swallowing, commenting as necessary.

- Complete the 'Eating' section regarding whether the applicant can feed themselves. Answer any relevant questions regarding changes in weight and the need for special diet orders.

- In the 'Walking' section, specify whether the applicant requires assistance and note any instances of falls in the past month or six months.

- Describe any mental health considerations, control over bowels and bladder, and note any concerns about confusion or aggressive behavior in the 'Mental' section.

- Address communication abilities by indicating the applicant's abilities to speak, understand, and respond. Note any issues with hearing or vision.

- Fill in the 'History' section regarding the applicant's residential history, past care needs, and any significant health changes over the last year.

- Complete the 'Cycle of daily events' and 'Eating patterns' sections, considering the applicant's daily activities, dietary habits, and social interactions.

- Conclude by entering the name and signature of the person providing the information, along with the date.

- Once completed, ensure all information is accurate. Users can save changes, download, print, or share the completed form as needed.

Start filling out your MO 812-1099 form online today!

You can send your 1099 forms electronically or by mail, depending on the specific guidelines provided by the IRS and Missouri Department of Revenue. Make sure to choose the method that works best for your situation. When mailing, use a secure envelope and allow enough time for delivery. If you need more assistance, USLegalForms provides tools that can simplify sending your MO 812-1099.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.