Loading

Get Tx Trs 6 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX TRS 6 online

The TX TRS 6 is an essential form for individuals seeking refunds from the Teacher Retirement System of Texas. This guide provides you with clear, step-by-step instructions to assist you in completing the form online efficiently and effectively.

Follow the steps to complete the TX TRS 6 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

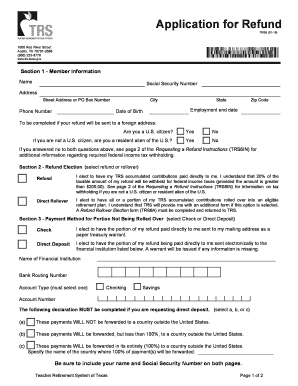

- Fill out Section 1 - Member Information. Provide your name, Social Security number, address, phone number, city, date of birth, state, zip code, and employment end date.

- If applicable, complete the U.S. citizenship question. Specify whether you are a U.S. citizen and if not, indicate your residency status.

- In Section 2 - Refund Election, choose your refund type: 'Refund' or 'Direct Rollover'. Read the implications of each option and select accordingly.

- Proceed to Section 3 - Payment Method. Decide whether you prefer to receive your refund by check or direct deposit and provide the necessary financial institution details.

- Complete the required declaration regarding the payment's forwarding if opting for direct deposit. Select the appropriate option based on your circumstances.

- In Section 4 - Waiver of Benefits, read and affirm your understanding of terminating TRS membership and the benefits relinquished. Sign the document within the required notary section.

- Ensure your name and Social Security number are included on both pages of the form, then save or download your completed form.

- Submit the completed TX TRS 6 to the Teacher Retirement System of Texas at the specified address.

Take the next step towards your refund by completing the TX TRS 6 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You must be vested in the Texas TRS system for at least 5 years to qualify for retirement benefits. Being vested means you have established eligibility for a monthly retirement benefit when you decide to retire. Understanding the vesting timeline is crucial for any educator planning their career. US Legal Forms can be a valuable resource to help you track your status and explore your retirement options.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.