Loading

Get Tx Comptroller 01-917 2006-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 01-917 online

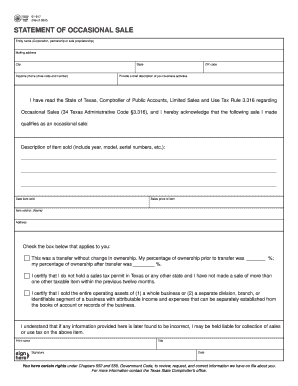

The TX Comptroller 01-917 form is essential for reporting occasional sales of taxable items in Texas. This guide provides step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out the TX Comptroller 01-917 form online.

- Press the ‘Get Form’ button to access the TX Comptroller 01-917 online and open it for completion.

- Enter the entity name, which may be your corporation, partnership, or sole proprietorship, in the corresponding field.

- Fill in your mailing address, including the city, state, and ZIP code in the respective sections.

- Provide your daytime phone number, including the area code, to ensure the Comptroller's office can contact you if necessary.

- In the space provided, write a brief description of your business activities to give context to the sale.

- Acknowledge that you have read the Limited Sales and Use Tax Rule by checking the appropriate box, which confirms your understanding.

- Detail the description of the item sold, including specifics such as year, model, and serial numbers as applicable.

- Indicate the date on which the item was sold by entering it in the designated area.

- Specify the sales price of the item sold in the corresponding field.

- Input the name of the person or entity to whom the item was sold.

- Fill out the address of the buyer in the space provided.

- Select the box that applies to your situation regarding transfer of ownership or sales tax permit. Provide any required percentages or clarification.

- Sign the form by printing your name, title, and adding your signature, followed by the date to verify the information.

- Once completed, review the form for accuracy before saving, downloading, printing, or sharing as needed.

Complete your TX Comptroller 01-917 form online today to ensure compliance and proper reporting.

To obtain your webfile number from the Texas Comptroller, you must register through their online portal. After successful registration, your webfile number will be provided, allowing you to manage your taxes online. This is essential for anyone looking to comply with the TX Comptroller 01-917 guidelines effortlessly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.