Get Tx Comptroller 01-339 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 01-339 online

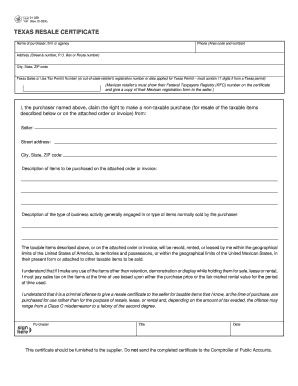

The Texas Resale Certificate, Form 01-339, is an essential document for purchasers claiming non-taxable purchases for resale. This guide provides clear and supportive instructions on filling out the form online, ensuring compliance with Texas sales tax requirements.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the purchaser, firm, or agency in the designated field.

- Provide the purchasing entity's phone number, including the area code.

- Complete the address section, including the street number, P.O. box or route number, city, state, and ZIP code.

- Input your Texas sales or use tax permit number, ensuring it contains 11 digits. If applicable, include the out-of-state retailer's registration number or the date applied for a Texas permit.

- For Mexican retailers, include the Federal Taxpayers Registry (RFC) number and ensure you have a copy of the Mexican registration form ready.

- Declare your claim to make a non-taxable purchase and fill in the seller’s name and address, including street, city, state, and ZIP code.

- State the description of the items you intend to purchase, referencing the attached order or invoice.

- Describe the general business activity or types of items typically sold by the purchaser.

- Acknowledge the conditions regarding the resale of taxable items, ensuring understanding of sales tax obligations for any use outside retention, demonstration, or display.

- Confirm your understanding of the legal implications of misusing the resale certificate, particularly regarding criminal offenses.

- Sign the document, stating your title and the date of completion.

- Once all information is filled out, save your changes, and you may choose to download, print, or share the form as needed.

Complete your Texas Resale Certificate 01-339 online today for an efficient filing process.

Get form

To fill out a Texas resale certificate, first, provide the purchaser's information, including the name and address. Then, detail the items that will be resold. Make sure to include your Texas Sales Tax Permit number in the designated area to comply with the TX Comptroller 01-339 regulations. Utilizing platforms like USLegalForms can be beneficial in obtaining the correct formats and accurate instructions for this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.