Loading

Get Tx Ap-133 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX AP-133 online

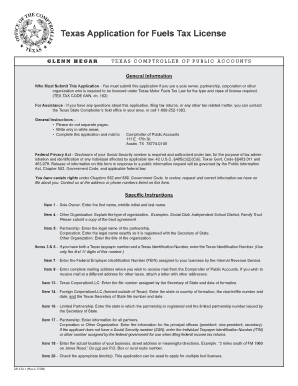

The Texas Application for Fuels Tax License, known as TX AP-133, is essential for organizations engaged in the motor fuels tax law. This guide will provide straightforward instructions on how to fill out this form online, ensuring you comply with all necessary requirements.

Follow the steps to complete the TX AP-133 online accurately.

- Press the ‘Get Form’ button to access the TX AP-133 document and open it to begin filling out the necessary fields.

- In Item 1, input the full name of the sole owner with the first name, middle initial, and last name. If this does not apply, proceed to Item 4.

- At Item 4, specify the type of organization by selecting from options such as Texas registered limited liability partnership or any other applicable category.

- In Item 5, enter the legal name of your partnership, company, corporation, or other organization exactly as registered.

- Complete Item 6 by providing your taxpayer number or Texas Identification Number, if applicable.

- Fill in Item 7 with your Federal Employer Identification Number (FEIN) assigned by the IRS.

- Enter your complete mailing address in Item 9, ensuring it is accurate for future communications.

- If you are a Texas Corporation or LLC, complete Item 13 with the file number and date of formation.

- In Item 17, provide details for all partners or principal officers, including names, titles, and identification numbers.

- For the business location, indicate the actual address in Item 18 without using P.O. Boxes.

- Fill in the appropriate license types and provide additional information in the designated sections.

- Finally, review all entered information for accuracy. Once confirmed, you can save your changes, download the completed form, or print it for submission.

Begin filling out the TX AP-133 online today to ensure compliance with Texas motor fuels tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain your Texas Comptroller XT number, you need to apply for a permit through the Texas Comptroller’s website. This process will involve completing the necessary forms and providing information about your business. Your XT number aids in your TX AP-133 reporting and ensures you meet Texas compliance standards.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.