Loading

Get Tx 74-176 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 74-176 online

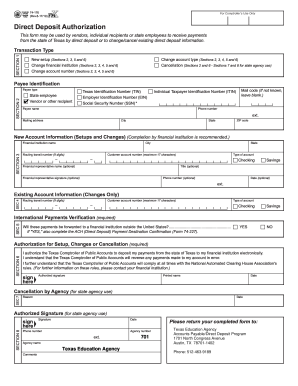

The TX 74-176 form is essential for individuals to authorize direct deposit payments from the state of Texas. This guide will assist you in navigating each section of the form online, ensuring a smooth completion process.

Follow the steps to successfully complete the TX 74-176 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In Section 1, select the appropriate transaction type. Options include new setup, change financial institution, change account number, change account type, or cancellation. Choose the option that applies to your situation.

- Move to Section 2 for Payee Identification. Select your payee type (e.g., vendor or state employee) and provide your Texas Identification Number (TIN), Employer Identification Number (EIN), Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN). Fill in your name, mailing address, phone number, and extension if applicable.

- Proceed to Section 3 for New Account Information if you’re setting up or changing an account. Include the financial institution's name, city, routing transit number (9 digits), customer account number (maximum 17 characters), and account type (checking or savings). Optionally, provide the financial representative's details.

- If you are making changes to an existing account, complete Section 4 with the existing account information, including the routing transit number and customer account number to verify the changes.

- In Section 5, indicate whether your payments will be forwarded to a financial institution outside the United States by selecting 'YES' or 'NO'. If you select 'YES', you must also complete the ACH (Direct Deposit) Payment Destination Confirmation using Form 74-227.

- Complete Section 6 for Authorization for Setup, Changes or Cancellation. This section must be filled out completely, including your signature, printed name, and date to authorize the requested actions.

- For state agency use, Section 7 requires the agency to provide a reason for cancellation, while Section 8 includes space for an authorized signature.

- Once you have filled out all the sections applicable, review your entries for accuracy. You can save your changes, download the filled form, print it, or share it as needed.

Complete your TX 74-176 form online with confidence; follow this guide for a seamless experience.

Filing the Texas franchise tax form requires a few essential steps. Gather all required financial documents, calculate your taxes accordingly, and ensure you meet the due dates established by the Comptroller. Completing the TX 74-176 form might be necessary depending on your business’s structure. If you encounter challenges while filing, uslegalforms can provide valuable resources and templates to assist you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.