Get Tx 1099-r Trs Information 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 1099-R TRS Information online

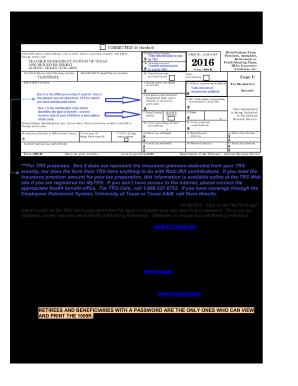

This guide provides a comprehensive overview of how to fill out the TX 1099-R TRS Information form online. Designed for retirees, beneficiaries, and former members, this tutorial will help you understand each section of the form to ensure accurate completion.

Follow the steps to complete the TX 1099-R TRS Information form online.

- Click ‘Get Form’ button to obtain the document and open it for editing.

- Review the first section of the form where you will enter your personal information. Ensure that your name, address, and social security number are accurate as they will be used for tax identification.

- In the income section, carefully input any payments received from TRS, including annuity payments, death benefits, and refunds. Make sure to refer to the corresponding boxes on the form to ensure correct entries.

- Consult the back of the form for explanations of each box to clarify any uncertainties you may have regarding the entries, especially Box 5 and its relation to insurance premiums.

- If you need to change your tax withholding preference, log into your MyTRS account and select the appropriate option, or alternatively complete and submit Form TRS 228A.

- Once you have filled in all the necessary information, review your entries for accuracy. Make any necessary corrections before proceeding.

- After verifying all details, you can save changes, download, print, or share the completed form as needed.

Complete your TX 1099-R TRS Information form online today for a seamless filing experience.

Get form

Related links form

R affects your taxes by informing the IRS of the retirement distributions you received during the year. This form directly impacts your taxable income and may determine your total tax liability. Proper handling of this information can significantly influence your tax outcome. For valuable insights on managing your 1099R reporting effectively, explore the TX 1099R TRS Information with resources available at USLegalForms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.