Get Tx 1099-r Trs Information 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 1099-R TRS Information online

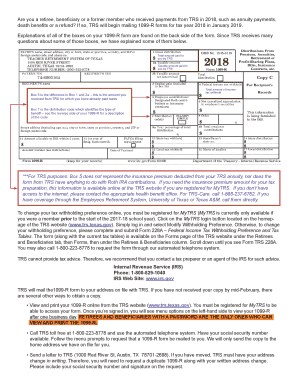

The TX 1099-R TRS Information form is crucial for retirees, beneficiaries, or former members who received payments from the Teacher Retirement System (TRS). Completing this form correctly assists in accurate tax filing and reporting. This guide will help you navigate the process of filling out this form online, ensuring you understand each section and field.

Follow the steps to accurately complete your TX 1099-R TRS Information form online.

- Click ‘Get Form’ button to access the TX 1099-R TRS Information form and open it in your preferred online editor.

- Begin by entering your personal information, including your name, social security number, and address as it appears on your TRS account.

- In the section detailing payments received, clearly indicate the total amount paid to you by TRS and the taxable amount, ensuring accuracy to avoid discrepancies.

- Refer to Box 5, which shows the difference between Box 1 and Box 2a, indicating the funds received that have already been taxed.

- In Box 7, input the appropriate distribution code that correctly reflects your type of benefit, following the guide provided on the back of the form.

- Verify the total amount of income tax withheld, ensuring that it matches your records and is accurately reflected on the form.

- Review all entries for accuracy before completing the form.

- Once all information is accurate, save your changes, and choose to download, print, or share the completed TX 1099-R TRS Information form as necessary.

Begin filling out your TX 1099-R TRS Information form online today for a smooth and accurate tax filing experience!

Get form

The IRS does consider pension income as taxable income, so it must be reported on your tax return. This means you must include it in your total income calculation for the year. Make sure you’re aware of any exceptions that might apply to your specific situation. For comprehensive understanding and assistance with tax implications, refer to the TX 1099-R TRS Information available at US Legal Forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.