Loading

Get Tn Rv-f1400301 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN RV-F1400301 online

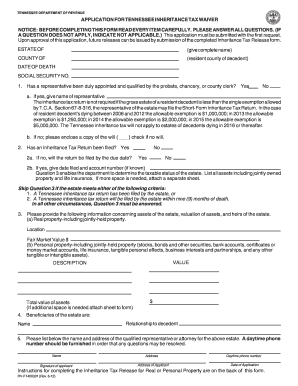

The TN RV-F1400301 form is an important document for individuals seeking a Tennessee inheritance tax waiver. This guide provides comprehensive instructions to help you successfully complete the form online, ensuring you navigate each section with ease.

Follow the steps to accurately fill out the TN RV-F1400301 form.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering the complete name of the estate owner in the designated field labeled 'Estate of'.

- Indicate the resident county of the decedent in the 'County of' field.

- Fill in the date of death of the decedent, making sure to use the correct date format.

- Provide the social security number of the decedent in the appropriate section.

- Respond to the question regarding whether a representative has been appointed by marking 'Yes' or 'No'. If 'Yes', include the representative's name.

- If 'No', indicate this and check the appropriate box to confirm if there is a will or not.

- Next, indicate if an inheritance tax return has already been filed. Provide the date filed and account number if applicable.

- If the estate meets the criteria to fill out question 3, list all the assets of the estate, ensuring to include location and fair market value.

- Detail the beneficiaries of the estate by listing their names and their relationship to the decedent.

- Lastly, provide the contact information of the qualified representative or attorney, including their name, address, and daytime phone number.

- After reviewing all entered information for accuracy, save the changes to your form, and prepare to download, print, or share it as necessary.

Complete your inheritance tax waiver application online today to ensure a smooth and efficient process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Tennessee inheritance laws ensure that assets are passed on to legal heirs, focusing on wills and beneficiary designations. With no inheritance tax, beneficiaries often receive their inheritance intact. Understanding state laws is vital, and resources such as TN RV-F1400301 can guide you through required documentation related to estate settlement.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.