Get Tn Bus 417 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN BUS 417 online

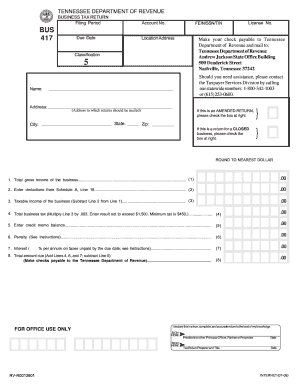

The TN BUS 417 is an essential business tax return form used by businesses in Tennessee. Completing this form accurately is crucial for compliance with state tax regulations and ensuring timely processing of your return.

Follow the steps to successfully fill out your TN BUS 417 online.

- Click the ‘Get Form’ button to access the TN BUS 417 form and open it in your browser.

- Begin by providing your account number, FEIN/SSN/TIN, and the location address where the return should be mailed. Make sure to double-check the accuracy of this information.

- Indicate the classification by selecting the appropriate license number that corresponds to your business type.

- Fill in the total gross income of the business on Line 1. Ensure you round this amount to the nearest dollar.

- On Line 2, enter the deductions as listed from Schedule A, Line 18. This requires you to calculate and input all permissible deductions.

- Subtract Line 2 from Line 1 to determine your taxable income, and enter the result on Line 3.

- Calculate the total business tax by multiplying your taxable income from Line 3 by the applicable tax rate. Enter the result on Line 4, ensuring it does not exceed $1,500, with a minimum tax of $450.

- For any credit memo balance, enter the amount on Line 5. If applicable, also detail any penalties or interest due on Lines 6 and 7.

- Finally, add Lines 4, 6, and 7, and then subtract Line 5 to determine the total amount due. Enter this on Line 8.

- Sign the form where indicated, stating that the information provided is true and accurate. Include the date of signing.

- Review your completed form for accuracy before saving your changes. You can then download, print, or share the form as needed.

Complete your TN BUS 417 online today to ensure timely compliance with Tennessee tax regulations.

Get form

Filing business taxes by yourself can be challenging, especially if you are unfamiliar with tax codes and filing requirements. The complexity often increases with your business size and structure, particularly under TN BUS 417 regulations. However, with the right resources and tools, it becomes more manageable. Using services offered by uslegalforms can significantly ease this burden, providing clear guidance and essential forms needed for filing.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.