Get Sc St-389 I 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

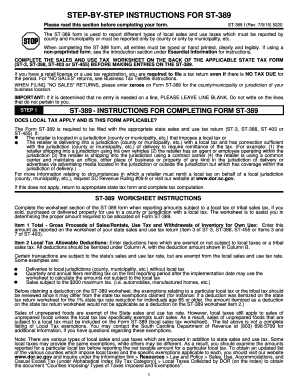

Tips on how to fill out, edit and sign SC ST-389 I online

How to fill out and sign SC ST-389 I online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out the tax form can pose a significant challenge and a major frustration without the right support provided.

US Legal Forms is designed as a digital solution for SC ST-389 I e-filing and offers numerous benefits for taxpayers.

Press the Done button in the top menu once you have completed it. Save, download, or export the filled template. Use US Legal Forms to ensure an easy and straightforward SC ST-389 I completion.

- Locate the template on the website within the relevant section or by using the search feature.

- Click the orange button to access it and wait until the loading is complete.

- Review the form and adhere to the guidelines. If you have never filled out the template before, follow the step-by-step instructions.

- Pay attention to the highlighted areas. They are editable and require specific information to be entered. If you are uncertain about what to input, refer to the guidelines.

- Always sign the SC ST-389 I. Utilize the built-in tool to create your electronic signature.

- Click on the date field to automatically insert the correct date.

- Review the document to make any necessary edits before submitting it.

How to amend Get SC ST-389 I 2016: personalize forms online

Experience a hassle-free and paperless method of altering Get SC ST-389 I 2016. Utilize our reliable online solution and conserve significant time.

Creating each document, including Get SC ST-389 I 2016, from the ground up takes excessive time, therefore having a proven solution of pre-uploaded form templates can significantly enhance your efficiency.

However, modifying them can be challenging, especially for documents in PDF format. Fortunately, our vast library features a built-in editor that allows you to conveniently complete and modify Get SC ST-389 I 2016 without leaving our site, so you won’t squander hours filling out your forms. Here's what you can accomplish with your document using our tools:

Whether you need to produce editable Get SC ST-389 I 2016 or any other form listed in our catalog, you're well on track with our online document editor. It's straightforward and secure, requiring no specialized skills. Our web-based tool is designed to manage nearly everything you could envision concerning file editing and completion.

Ditch the outdated methods of handling your forms. Opt for a professional solution to assist you in streamlining your processes and making them less reliant on paper.

- Step 1. Locate the required form on our website.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize specialized editing features that permit you to insert, delete, annotate and emphasize or obscure text.

- Step 4. Generate and add a legally-valid signature to your document by using the sign option from the upper toolbar.

- Step 5. If the form layout isn’t as you require, use the options on the right to delete, add more, and rearrange pages.

- Step 6. Insert fillable fields so other individuals can be invited to complete the form (if necessary).

- Step 7. Distribute or send the document, print it, or choose the format in which you would like to receive the file.

Related links form

To secure a sales tax exemption certificate in South Carolina, you should file the SC ST-389 I form. This form outlines your business type and qualifies you for exemptions if you meet the necessary conditions. Our platform offers helpful resources and services to simplify the application process and ensure you receive your certificate promptly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.