Get Sc Sc Sch. Tc-38 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC SC SCH. TC-38 online

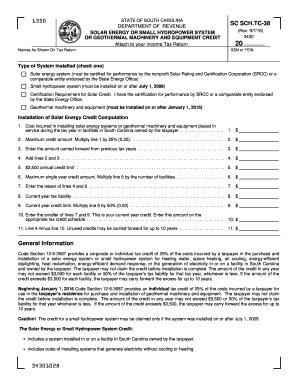

The SC SC SCH. TC-38 form allows taxpayers in South Carolina to claim tax credits for solar energy systems, small hydropower systems, or geothermal machinery and equipment. This guide provides step-by-step instructions for accurately completing the form online, ensuring you maximize your credits while fulfilling your tax obligations.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Enter your name as it appears on your tax return in the designated field.

- Provide your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the appropriate section.

- Indicate the type of system installed by checking one of the provided boxes: solar energy system, small hydropower system, or geothermal machinery and equipment. Ensure that you meet the certification requirements for the selected system.

- In the section for installation costs, enter the total costs incurred for installing the system during the tax year. This value should reflect expenses for systems placed in service within South Carolina.

- Calculate the maximum credit amount by multiplying the amount from the previous line by 25%. Enter this value in the designated field.

- If applicable, enter any amount of credit carried forward from previous years in the provided section.

- Add lines 2 and 3 together and enter this total in the respective field.

- Review the $3,500 annual credit limit and enter this amount in the specified section.

- Calculate the maximum single year credit amount by multiplying the annual credit limit by the number of facilities. Input this calculation in the line provided.

- Determine and enter the lesser amount between lines 4 and 6 in the designated space.

- Calculate your current year tax liability and enter it into the appropriate field.

- Compute your current year credit limit by multiplying the tax liability by 50% and enter this value.

- Enter the smaller amount from lines 7 and 9 in the final line indicated for your current year credit. This amount should be noted on the relevant tax credit schedule.

- Finally, subtract line 10 from line 4 to obtain the amount of unused credits that may be carried forward for up to ten years. Enter this amount as well.

Start completing your SC SC SCH. TC-38 form online to take advantage of available tax credits.

Get form

Related links form

Yes, you can file a South Carolina extension electronically. Use the South Carolina Department of Revenue’s online portal for submitting your extension request. This option is convenient, as it allows you to ensure your extension is filed on time and is processed efficiently. By managing your tax responsibilities this way, you can focus on maximizing your solar tax benefits under SC SC SCH. TC-38.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.