Loading

Get Ar Dfa Ar1000d 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA AR1000D online

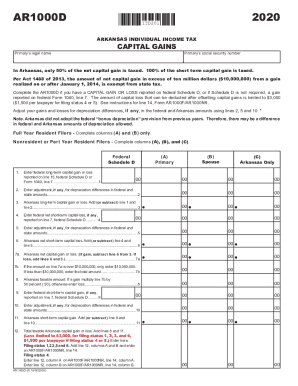

The AR DFA AR1000D is an important form used for reporting capital gains and losses for Arkansas tax purposes. Completing this form accurately is essential for ensuring compliance with state tax regulations and for determining any potential tax liabilities. This guide provides a comprehensive overview of how to fill out the AR1000D online effectively.

Follow the steps to accurately complete the AR DFA AR1000D form.

- Click the ‘Get Form’ button to obtain the AR1000D form and open it for editing.

- Enter the primary's legal name in the designated field. Ensure that the name matches the identification documents.

- Input the primary's social security number in the next field. Make sure this number is accurate to avoid any processing delays.

- If applicable, indicate any capital gains or losses reported on federal Schedule D, or specify if Schedule D is not required.

- For lines 1 and 2, enter the federal long-term capital gain or loss as reported on your federal Schedule D. Adjustments for any depreciation differences should also be reflected here.

- Complete lines 3 through 12 by adding or subtracting the relevant amounts under the Arkansas columns. Make sure to accurately calculate any tax adjustments as indicated.

- Once all fields are filled out, review your entries for accuracy and completeness.

- Finally, save your changes, download a copy of your completed form, and print or share it as needed.

Take action now by filling out your AR DFA AR1000D form online today.

Related links form

To find out about your refund, use the IRS's " Where's My Refund?" tool. If it has no information, check again in a week or so. These typically say the filer owes more money to the IRS or request more information. ... Always send correspondence to the IRS via certified mail, and don't lose the receipts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.