Loading

Get Sc Pr-26 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC PR-26 online

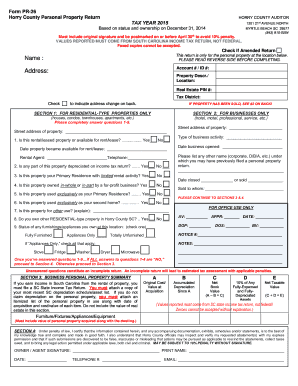

Filling out the SC PR-26 form is an essential process for reporting personal property in Horry County. This guide will provide you with clear, step-by-step instructions to efficiently complete the form online.

Follow the steps to fill out the SC PR-26 form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information, including your name, account number, and address. Ensure that all provided details are accurate.

- In the property description section, specify the type of property you are reporting. For residential properties, complete Section 1 by addressing questions 1 to 9 regarding the rental status and ownership.

- If applicable, proceed to Section 2 to provide information on business-type properties. Indicate the street address of the property and describe the business activity.

- Carefully answer all questions in Section 1 and Section 2. If any answers lead to further sections or require additional details, make sure to follow the prompt to continue filling out the necessary information.

- Move to Section 3 for business personal property summary. Here, detail the original cost, accumulated depreciation, net book value, and any fully-expensed and fully-depreciated assets. Attach any relevant documents as needed.

- In Section 4, certify that the information provided is true and complete by signing and dating the form. Make sure to include your contact information.

- Finally, review the completed form for any inaccuracies. Once satisfied, you can save changes, download the form for your records, print a hard copy, or share it as required.

Complete your SC PR-26 form online today to ensure your personal property is accurately reported.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out an SC title transfer requires you to provide specific information, including vehicle details, buyer and seller information, and the reason for the transfer. Both parties must sign the title, marking the official transfer of ownership. Referencing resources from USLegalForms can simplify this process and help you avoid common pitfalls.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.