Loading

Get Sc Dor Wh-1606 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR WH-1606 online

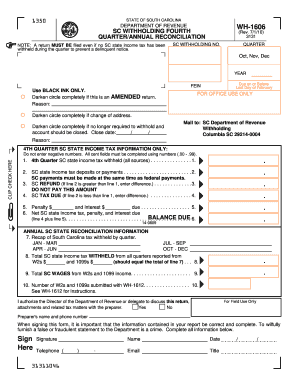

The SC DoR WH-1606 form is essential for reporting state income tax withheld during the fourth quarter and for annual reconciliation in South Carolina. This guide provides step-by-step instructions to help you successfully complete the form online.

Follow the steps to effectively complete the SC DoR WH-1606 form.

- Click ‘Get Form’ button to obtain the SC DoR WH-1606 and open it in your preferred editor.

- Fill in the top portion of the form with your business name and address, SC withholding number, Federal Employer Identification Number (FEIN), and the year you are filing for.

- Indicate if this is an amended return by completely darkening the circle provided. If applicable, provide a reason in the line below.

- If there is a change of address, darken the corresponding circle and provide your new address.

- If you are no longer required to withhold taxes, darken the relevant circle and provide the closure date.

- For lines 1 to 6, use only fourth quarter figures. Enter the total SC state income tax withheld from all sources on line 1.

- On line 2, enter the total SC state income tax deposits or payments made in the fourth quarter.

- Line 3 is for the SC refund amount, if line 2 is greater than line 1, enter the difference, noting that this amount should not be paid.

- On line 4, if line 1 exceeds line 2, enter the difference as SC tax due.

- Line 5 requires you to enter any penalty and interest due.

- Line 6 is for calculating the net SC state income tax, penalty, and interest due. Add line 4 and line 5.

- For the annual reconciliation, fill out lines 7 to 10 with the relevant amounts from W2s and 1099s.

- After completing all fields, ensure all numbers are written clearly and correctly, using black ink only.

- Once finalized, save your changes, and you can then download, print, or share the completed form as needed.

Complete the SC DoR WH-1606 online today to ensure accurate tax reporting and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To acquire a South Carolina sales tax ID number, you must apply through the South Carolina Department of Revenue's online portal. The application will require basic business information and usually, a valid federal ID. Once processed, you will receive your sales tax ID number, allowing you to collect sales tax from customers.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.