Loading

Get Sc Dor Wh-1605 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR WH-1605 online

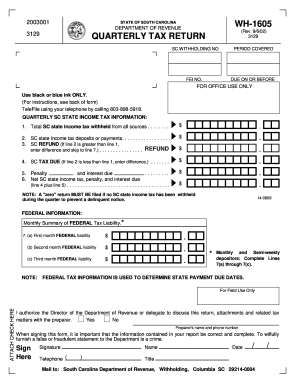

Filling out the SC DoR WH-1605 is an essential task for ensuring compliance with South Carolina state tax regulations. This guide will walk you through each section of the form to help you complete it accurately and efficiently.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to access the WH-1605 form, which you will fill out online.

- In the first section, enter your SC withholding number and the federal employer identification number (FEI No.), ensuring that the information is accurate. Specify the period covered for the quarter.

- Complete the quarterly SC state income tax information. Start with line 1 by entering the total amount of SC state income tax withheld from all sources.

- On line 2, input the total SC state income tax deposits or payments made during the quarter.

- If line 2 exceeds line 1, enter the difference on line 3 as your SC refund amount. If line 1 exceeds line 2, skip to line 4.

- If applicable, calculate any SC tax due by entering the difference from line 1 minus line 2 on line 4.

- Consider any penalties and interest due on line 5. Then, calculate the net amount due, combining line 4 and line 5, and enter it on line 6.

- For federal information, complete lines 7(a) through 7(c) with your monthly federal tax liabilities for the first, second, and third months as needed.

- Confirm your entries are correct, sign where indicated, and provide your telephone number. This information is crucial for processing your return.

- Finally, ensure all numbers are clearly written without any slashes or commas, use black or blue ink, and follow the instructions regarding attachments. You can then save, download, print, or share your completed form.

Complete your SC DoR WH-1605 online efficiently by following these steps.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

On the W4 form, you will indicate 0 or 1 allowances in the space provided in Step 5. Claiming 0 means the highest amount of taxes will be withheld, while claiming 1 offers a lower withholding rate. Make sure to evaluate your financial situation carefully to choose wisely. The SC DoR WH-1605 can guide you on how allowances work in relation to your W4 form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.