Loading

Get Pa Dor Pa-40 F - Schedule F 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DoR PA-40 F - Schedule F online

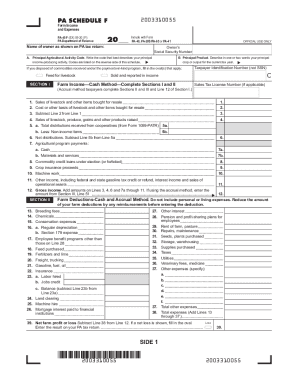

This guide provides step-by-step instructions to help users fill out the PA DoR PA-40 F - Schedule F online. Completing this form accurately is essential for reporting farm income and expenses appropriately.

Follow the steps to effectively complete the PA-40 F - Schedule F.

- Press the ‘Get Form’ button to access the necessary form and open it in your online editor.

- Enter the year for which you are reporting (indicated as '20___' on the form). Make sure this corresponds to your tax year.

- Provide your name as shown on your PA tax return, followed by your Social Security Number in the designated fields. If applicable, include your Sales Tax License Number.

- In Section I, enter the Principal Agricultural Activity Code that best describes your farm's income-generating activity. This code can be found on the reverse side of the form.

- Describe in one or two words your principal product for the current tax year, then complete the fields for commodities received under the payments-in-kind program, if applicable.

- Report your farm income by filling out Sections I and II of the form for cash method participants. Make sure to detail your sales of livestock, produce, and any other income sources in the corresponding lines.

- Proceed to Section II to list all applicable farm deductions. Ensure that you only include expenses that are ordinary and necessary for your farming operations.

- Calculate your total farm expenses and net profit or loss by subtracting total expenses from your gross income in the relevant lines.

- If you are using the accrual method, complete Section III, detailing your gross income and expenses accordingly.

- Review all entries thoroughly for accuracy, then save your changes. You can download, print, or share the completed form as necessary.

Complete your PA DoR PA-40 F - Schedule F online now to ensure accurate reporting of your farm income and expenses.

Pennsylvania Extends Personal Income Tax Filing Deadline to May 17, 2021. Harrisburg, PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments is extended to May 17, 2021.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.