Loading

Get Sc Dor St-390 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR ST-390 online

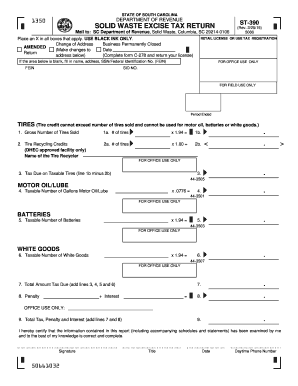

Filling out the SC DoR ST-390 online can be a straightforward process. This guide provides clear instructions on completing the Solid Waste Excise Tax Return to ensure compliance and accuracy.

Follow the steps to successfully complete the SC DoR ST-390 online.

- Click the ‘Get Form’ button to access the ST-390 form and open it in your preferred online editor.

- Identify and mark the applicable boxes at the top of the form, such as 'Change of Address' or 'Business Permanently Closed'. Ensure to use black ink for all entries.

- Fill in the retail license or use tax registration details in the designated area, including the name, address, and SSN/Federal Identification Number (FEIN), if not already completed.

- Enter the gross number of tires sold on line 1a. Multiply this number by 1.94 and place the result on line 1b.

- For tire recycling credits, enter the name of the DHEC-approved facility on line 2 and the number of tires recycled in line 2a. Multiply the number of tires on line 2a by 1.00 and enter the result on line 2b.

- Calculate the tax due on taxable tires by subtracting line 2b from line 1b. Enter this amount on line 3.

- Enter the taxable number of gallons of motor oil or lubricant sold on line 4. Multiply it by 0.0776 and enter the result.

- Enter the taxable number of batteries sold on line 5. Multiply this number by 1.94 and write the result on the line.

- Enter the taxable number of white goods sold on line 6. Multiply this number by 1.94 and document the result.

- Add the total amounts due from lines 3, 4, 5, and 6, and write the total on line 7.

- Calculate any penalties and interest, if needed, and document these totals on line 8.

- Finally, add the total from line 7 and line 8 to enter the overall amount due on line 9.

- Review the form for accuracy, then save the changes. Options to download, print, or share the completed form are available depending on your online editor.

Begin filling out the SC DoR ST-390 online to ensure your Solid Waste Excise Tax Return is submitted accurately and on time.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The EZ tax form is designed for straightforward filing and simplifies the process for you. You'll start by entering your basic information and income, following the instructions provided. If you have specific states like South Carolina in mind, using the SC DoR ST-390 may offer you additional insights and help you file effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.