Loading

Get Nj Nj-1040-hw 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-1040-HW online

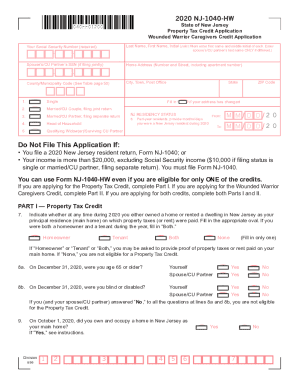

The NJ NJ-1040-HW form is essential for individuals in New Jersey seeking property tax credits and caregivers of qualifying armed services members. This guide will take you through the online process of completing the form step-by-step, ensuring all necessary information is accurately provided.

Follow the steps to fill out the NJ NJ-1040-HW online.

- Press the ‘Get Form’ button to access the NJ NJ-1040-HW and open it for completion.

- Enter your social security number as required at the top of the form.

- If filing jointly, include your spouse’s or civil union partner’s social security number.

- Provide your full name as it appears on legal documents, ensuring that if you are filing jointly, both individuals’ names are correctly listed.

- Fill in your home address, including any apartment number, city, county, state, and ZIP code.

- Select your filing status from the listed options: Single, Married/CU Couple filing jointly, Married/CU Partner filing separately, Head of Household, or Qualifying Widow(er)/Surviving CU Partner.

- If you are a part-year resident, indicate the months and days of residency in New Jersey for the year 2020. Make sure to fill in the From and To dates.

- For the Property Tax Credit, indicate whether you were a homeowner, tenant, both, or neither, by filling in the appropriate oval.

- Complete the eligibility questions regarding age and disability status for you and your spouse/CU partner.

- If certain criteria are met, move to Part II to address the Wounded Warrior Caregivers Credit, confirming your caregiving situation.

- Enter the necessary data regarding federal disability compensation and calculate the allowable credit.

- Sign the form declaring the information is true and complete, and ensure that any necessary signatures are obtained if filing jointly.

- Once completed, save your changes, download the form, print it for your records, or share it as needed.

Start the process now to complete and submit your NJ NJ-1040-HW form online.

The New Jersey Gross Income amount from your 2021 return can be found on line 29 of your 2021 NJ-1040 return. Please note, if the Division of Taxation has made adjustments to your return for the previous year, the amount on the . pdf of your return may not match what is on file.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.