Loading

Get Sc Dor Sc656 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC656 online

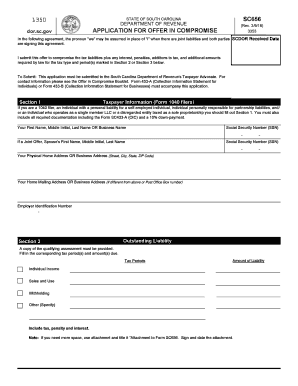

Filling out the SC DoR SC656 form, an application for an offer in compromise, can simplify tax liability management. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the SC DoR SC656 form.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Section 1 requires you to provide taxpayer information. If you are a 1040 filer or a self-employed individual, fill in your name, Social Security number, and address details. If filing jointly with a spouse, include their information as well.

- Move to Section 2 to indicate your outstanding tax liabilities. Include the specific tax periods and the amounts due. Make sure to provide copies of any qualifying assessments.

- In Section 3, state your reason for the offer. Select either 'Doubt as to Collectibility' or 'Exceptional Circumstances' and provide a written explanation if required.

- Section 4 is where you indicate your offer amount. Remember, the offer must be greater than $0 and in whole dollars only. Attach a check for 10% of your offer amount.

- In Section 5, specify the source of funds for your offer. You may include information about borrowing, loans, or selling assets.

- Ensure that you have filed all required tax returns and check the boxes that apply to your tax payment requirements in Section 6.

- Once all sections are completed, review the terms in Section 7. Sign and date the form. Ensure you authorize the SCDOR to contact you if necessary.

- Finally, save your changes, and you may download, print, or share the completed form as needed.

Complete your SC DoR SC656 form online to expedite your application for an offer in compromise.

Related links form

For sending your South Carolina state taxes, you will send them to the address specified by the SC Department of Revenue, which is typically PO Box 125, Columbia, SC 29214. Always confirm the address for your specific tax form as it may vary based on your filing type. The SC DoR SC656 has comprehensive information on where to send your taxes and maintain compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.