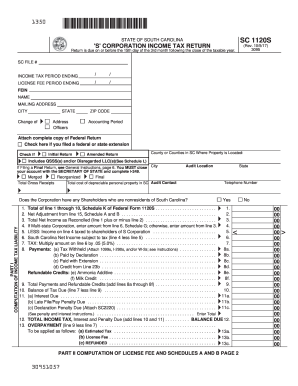

Get Sc Dor Sc1120s 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign SC DoR SC1120S online

How to fill out and sign SC DoR SC1120S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing tax documentation can turn into a considerable challenge and major hassle if inadequate support is provided.

US Legal Forms serves as an online solution for SC DoR SC1120S electronic filing and provides numerous advantages for taxpayers.

Use US Legal Forms to guarantee a secure and straightforward SC DoR SC1120S completion.

- Obtain the blank form online in the designated section or through the search engine.

- Click the orange button to open it and wait for it to load.

- Examine the blank and focus on the guidelines. If you haven't filled out the form before, follow the step-by-step instructions.

- Pay attention to the highlighted fields. These are fillable and need specific information to be inputted. If uncertain about what to include, refer to the guidelines.

- Always sign the SC DoR SC1120S. Use the built-in feature to create the electronic signature.

- Click the date field to automatically include the correct date.

- Review the form to verify and modify it prior to submission.

- Click the Done button in the upper menu when you have completed the form.

- Save, download, or export the finished form.

How to modify Get SC DoR SC1120S 2015: personalize forms online

Experience a hassle-free and paperless method of modifying Get SC DoR SC1120S 2015. Utilize our dependable online solution and conserve a significant amount of time.

Creating every document, including Get SC DoR SC1120S 2015, from the ground up demands too much effort, so having a proven solution of pre-uploaded form templates can work wonders for your productivity.

However, adjusting them can be challenging, particularly with documents in PDF format. Fortunately, our expansive catalog includes a built-in editor that enables you to swiftly fill out and modify Get SC DoR SC1120S 2015 without needing to leave our site, ensuring you don't waste your valuable time completing your forms. Here's what you can accomplish with your file using our tools:

Whether you need to finalize editable Get SC DoR SC1120S 2015 or any other template available in our catalog, you're well on your way with our online document editor. It's straightforward and secure and does not require you to have specialized skills.

Our web-based solution is designed to manage practically everything you can envision when it involves file editing and completion. Stop relying on outdated methods for managing your forms. Opt for a more effective solution to assist you in streamlining your tasks and make them less reliant on paper.

- Step 1. Locate the desired form on our site.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Utilize our specialized editing tools that allow you to add, remove, annotate, and emphasize or redact text.

- Step 4. Create and append a legally-binding signature to your document by using the sign option in the top toolbar.

- Step 5. If the template layout doesn’t appear the way you require, use the tools on the right to delete, add more, and rearrange pages.

- Step 6. Incorporate fillable fields so that others can be invited to complete the template (if necessary).

- Step 7. Distribute or send the document, print it out, or select the format in which you'd like to download the file.

Get form

South Carolina does not require LLCs to file annual reports. Although, you are responsible for filing other tax forms, including the SC DoR SC1120S, to keep your business in compliance. This allows you to focus on growing your LLC without the worry of annual reporting. For further assistance in managing your compliance, consider exploring the tools provided by uslegalforms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.