Loading

Get Sc Dor Sc1120 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1120 online

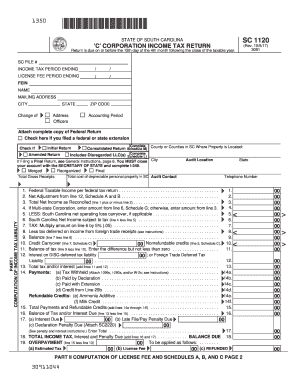

Filling out the SC DoR SC1120 form online can seem daunting, but with a clear understanding of each section, the process becomes much simpler. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your SC DoR SC1120 online.

- Press the ‘Get Form’ button to access the SC DoR SC1120 form and open it in your editing interface.

- Enter your State of South Carolina file number and the income tax period ending date. This information is crucial for identifying your submission correctly.

- Fill in the federal employer identification number (FEIN), the name of your corporation, and mailing address, ensuring that the details are accurate.

- Mark if there is a change of address or if this is your initial return, final return, or if you filed a federal or state extension. You will also need to indicate whether you are a multi-state corporation.

- Complete Part I, starting with the computation of income tax liability. Input your federal taxable income as stated on your federal tax return and any adjustments from Schedules A and B.

- Continue filling out the lines as directed, calculating total net income and the South Carolina net income subject to tax. Be meticulous in following through the computations.

- Proceed to fill in balances for tax credits, payments, and any refundable credits you may apply for. Make sure to check your calculations to ensure accuracy.

- In Part II, provide the computation of the license fee and summarize any additional information required in the schedules. It is essential to be thorough in detailing any multi-state corporation allocations.

- Review all entries on the form, confirming that each section is completed accurately and reflects your corporation's financial activities.

- Once satisfied with the completion of the SC DoR SC1120, you can save changes, download the form, print it for your records, or share it electronically as needed.

Take the next step and complete your SC DoR SC1120 form online today to ensure timely and accurate submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When asked if you are exempt from withholding, evaluate your income and tax liability for the year. If you expect to owe no federal tax, you may answer 'yes.' However, if you are unsure, consider consulting the SC DoR SC1120 resources to make a well-informed decision.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.