Loading

Get Ca Ftb 589 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 589 online

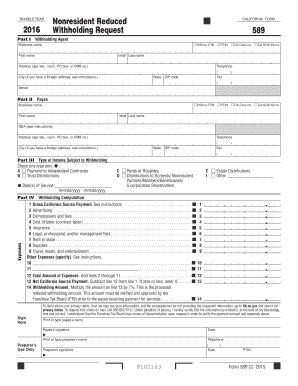

The CA FTB 589 is a Nonresident Reduced Withholding Request form used to apply for a reduction in withholding on California source payments. This guide provides a step-by-step approach to ensure you fill out the form accurately and efficiently.

Follow the steps to complete the CA FTB 589 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In Part I, enter the withholding agent's information. Indicate your Tax Identification Number (TIN) by selecting the appropriate checkbox. Ensure that you only provide either business or individual details but not both.

- Move to Part II, where you need to provide the payee's information. Similar to Part I, indicate the correct TIN and ensure that only business or individual details are filled out.

- For Part III, select the type of income subject to withholding by checking the appropriate box. Enter the date(s) of service in the specified format.

- In Part IV, begin the withholding computation. First, enter the total gross California source payment expected in line 1. This should align with any contracts for services.

- Add any applicable expenses in lines 2-11 as specified in the instructions. Make sure to document each expense thoroughly and attach any supporting documentation if necessary.

- Calculate the total amount of expenses in line 12 by adding lines 2 through 11. Next, determine the net California source payment for line 13 by subtracting line 12 from line 1.

- Finally, calculate the withholding amount in line 14 by multiplying the net California source payment by 7%. This is your proposed reduced withholding amount.

- Complete the signature section by signing the form and entering the date. If applicable, the preparer should also fill in their details and signature.

- Review the form for accuracy, then save your changes. You may choose to download, print, or share the completed form as needed.

Join others in completing their forms online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To request a non-resident withholding exemption in California, you need to complete the necessary request forms as specified in the CA FTB 589. This includes providing information about your income sources, residency status, and any relevant documentation. Submitting this information promptly to your payer is crucial for the exemption process. UsLegalForms can streamline your request by offering templates and tailored guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.