Loading

Get Mi Dot 4567 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 4567 online

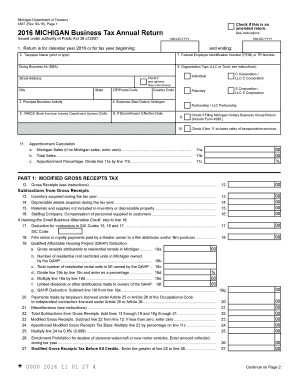

The MI DoT 4567 form serves as the Michigan Business Tax Annual Return, essential for businesses operating in Michigan. This guide will walk you through the process of completing the form online with clear, concise steps tailored to your needs.

Follow the steps to successfully complete the MI DoT 4567 online.

- Press the ‘Get Form’ button to access the MI DoT 4567 form and open it in your online editor.

- Enter the calendar year for which you are filing or the tax year beginning and ending dates in MM-DD-YYYY format.

- Fill in the taxpayer name accurately by printing or typing it as required in the designated field.

- Provide the Federal Employer Identification Number (FEIN) or TR Number and the Doing Business As (DBA) name, if applicable.

- Select your organization type from the options provided (e.g., LLC or Trust).

- Enter your street address, city, state, ZIP code, and country code. Check the box if you have a new address.

- Describe the principal business activity in the space provided.

- Indicate the start date of your business operations in Michigan.

- Input your NAICS code, which identifies your industry.

- If applicable, enter the date your business was discontinued.

- Complete the apportionment calculations by entering Michigan sales, total sales, and the apportionment percentage.

- Finalize your submission by saving your changes or opting to download, print, or share the completed form.

Begin your document completion online by filling out the MI DoT 4567 today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Michigan form 4567 is used for filing the corporate income tax return for businesses operating within the state. This form captures essential information about your corporation's income, expenses, and tax calculations. Completing this form accurately is vital for your compliance and financial health. You can rely on MI DoT 4567 for guidance during this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.