Loading

Get Sc Dor Sc1040x 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040X online

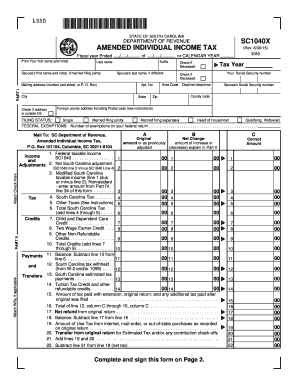

The SC DoR SC1040X is a form used for amending individual income tax returns in the state of South Carolina. This guide provides clear, step-by-step instructions to help you successfully complete the form online, ensuring you correctly report any changes to your income or filing status.

Follow the steps to complete the SC DoR SC1040X online.

- Click the ‘Get Form’ button to obtain the SC1040X and open it in your editing tool.

- In Part I, enter the tax year you are amending in the designated space. Complete the name and social security number for each individual included in the return.

- Include your current mailing address, including county code and telephone number. If you have a foreign address, check the box indicating it is outside of the United States and include the full address.

- Select your filing status from the options provided: Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er). Note that you cannot change your filing status from joint to separate after the original filing due date.

- Indicate the number of exemptions claimed on your original federal return.

- Proceed to Part II to enter return information. Complete columns A, B, and C for lines 1-14 based on your original return and any necessary corrections.

- For each line, enter the amounts from your original return in Column A, any net changes in Column B, and the adjusted amounts in Column C.

- Carefully explain any changes made in Part V, including references to the specific line numbers where changes were made.

- If you are due a refund, mark your refund option in Part III and fill in your direct deposit information if choosing that method.

- Review the entire form for accuracy before submitting, ensuring all required signatures are included.

- You can save changes, download a copy of the completed form, and print it for your records or submit electronically as required.

Complete your SC DoR SC1040X online today to ensure your tax records are accurate.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can file a South Carolina extension electronically, which provides you with more time to complete your tax return. The SC DoR allows electronic submission of extension requests, including any necessary forms related to the SC DoR SC1040X. This option makes it easy to manage your tax deadlines effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.