Loading

Get Sc Dor Sc1040 Instructions 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040 Instructions online

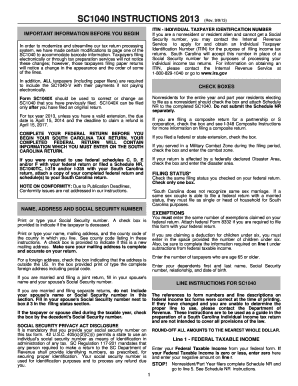

Filling out the SC DoR SC1040 form can be a straightforward process when you follow the right guidance. This guide provides clear instructions to help you complete the form accurately, ensuring that all necessary details are included.

Follow the steps to successfully fill out the SC DoR SC1040 form online.

- Press the ‘Get Form’ button to access the SC1040 form and open it for editing.

- Begin by completing your federal tax return, as information from it will be needed on the SC1040 form.

- Check the appropriate boxes indicating your filing status, including if you are a nonresident or filing a composite return.

- Enter your name, address, and Social Security number in the specified fields. Make sure to check if your mailing address has changed.

- Fill in the exemptions section by stating the number of exemptions as claimed on your federal return and include dependents' details if applicable.

- Input your federal taxable income and ensure that you round off amounts to the nearest whole dollar as instructed.

- Proceed to fill out the additions and subtractions from your federal taxable income as required by the instructions for each line.

- Calculate your South Carolina tax based on the provided tax tables or rates depending on your taxable income.

- Review all entries for accuracy, attach any necessary documentation, and proceed to save changes, download, print, or share your completed form.

Start completing your SC DoR SC1040 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

SC form 8453 is a declaration for electronic filing of a South Carolina tax return. It serves as a way to authenticate your online submission and ensures that everything is adequately documented. For understanding the specifics of submitting this form, zip over to the SC DoR SC1040 Instructions that detail its significance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.