Loading

Get Sc Dor Sc1040 Instructions 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040 Instructions online

This guide offers clear and supportive instructions for completing the SC DoR SC1040 form online. Follow the steps diligently to ensure accurate completion and timely submission.

Follow the steps to successfully complete your SC DoR SC1040 Instructions.

- Press the ‘Get Form’ button to access the SC DoR SC1040 form and open it in your online editor.

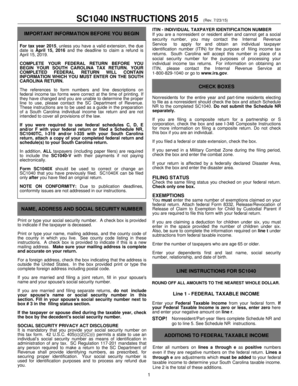

- Before you start, ensure you have completed your federal tax return. Gather all necessary documents, including your Federal Taxable Income.

- In the section for personal details, print or type your name, current mailing address, social security number, and indicate if you have a new mailing address.

- Check the appropriate box for your filing status, ensuring it matches your federal return status. Only one box should be checked.

- Enter the number of exemptions claimed on your federal return, along with any dependents' details, including their names and social security numbers.

- Provide your Federal Taxable Income as reported on your federal return. If it is less than or equal to zero, enter zero and proceed accordingly.

- Complete the additions to your federal taxable income, following the instructions for each line carefully to determine your South Carolina taxable income.

- Fill out the deductions and any other subtractions from your income. Ensure you account for any applicable locations and conditions outlined in the guidance.

- Calculate the tax due using the relevant SC1040 tax tables based on your taxable income, which may involve referring to financial calculations.

- Choose how you want to receive your refund, either by direct deposit or a mailed check, and provide the necessary banking details if applicable.

- Review your completed form meticulously. Attach the required documentation, such as W-2s or any supporting schedules.

- Save your changes, then download, print, or share the completed form as required. Follow the instructions for submitting along with any payment, if applicable.

Complete your SC DoR SC1040 form online today for an efficient tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The qualifying retirement income deduction allows eligible individuals to deduct a portion of their retirement income from their taxable earnings in South Carolina. This deduction includes income from pensions, annuities, and certain retirement plans, and the specifics can vary annually. Always consult the SC DoR SC1040 Instructions to stay updated and ensure you harness the full potential of this beneficial tax deduction.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.