Loading

Get Sc Dor Sc1040 Instructions 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040 Instructions online

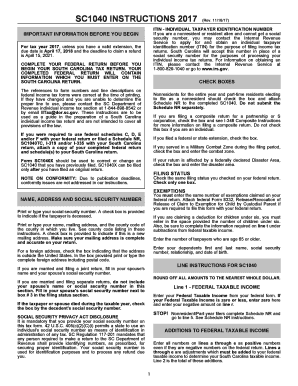

Filling out the SC DoR SC1040 can be a straightforward process if you follow the proper steps. This guide aims to provide clear instructions on each section of the form to ensure a smooth and accurate submission.

Follow the steps to complete the SC DoR SC1040 Instructions effectively.

- Press the ‘Get Form’ button to access the SC1040 form and open it in your designated online editor.

- Begin by completing your federal tax return, as you will need some information from it to fill the SC1040 correctly. Ensure that your federal return is finalized before you proceed.

- Locate and fill out the checkboxes at the top of the form. Indicate if you are a nonresident or if other specific circumstances apply, like military service or filing an extension.

- Proceed to the filing status section by checking the same status you selected on your federal return. Remember to only check one box.

- In the exemptions section, enter the same number of exemptions that you claimed on your federal return. If applicable, attach federal Form 8332 for any child exemptions.

- Complete the personal information section including your name, address, and social security number. If this is a new mailing address, mark the appropriate checkbox.

- On the income lines, carefully input your federal taxable income, adding any required adjustments. Ensure that you do not enter negative amounts here.

- Fill in the addition and subtraction lines with the appropriate figures as directed, ensuring to follow the guidance given for each line.

- Calculate your South Carolina tax based on the information provided from the income and tax tables. If your income is $100,000 or more, use the provided tax rate schedule.

- Review all entered information for accuracy and completeness, correcting any errors before proceeding.

- Finally, select your preferred method for receiving any refund due, and sign and date the form. If applicable, attach necessary documentation.

- Once satisfied with your form, you can save, download, print, or share the completed SC1040 form as needed.

Complete your SC DoR SC1040 Instructions online today for a smooth filing experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form SC1040 is the South Carolina Individual Income Tax Return, used to report personal income to the state. This form helps determine your tax liability or refund due after filing. To understand how to complete it, refer to the SC DoR SC1040 Instructions for clear guidance. If you need help with the preparation, UsLegalForms offers templates and resources to assist you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.