Loading

Get Sc Dor Sc 990-t 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC 990-T online

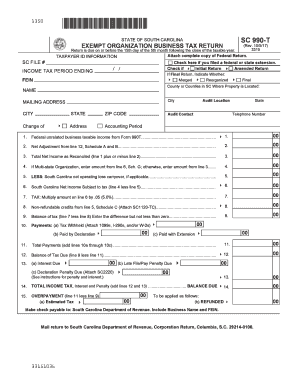

The SC DoR SC 990-T is the state of South Carolina's Exempt Organization Business Tax Return. This guide provides a clear, step-by-step approach to completing the form online, ensuring you understand each component and requirement needed for successful submission.

Follow the steps to complete the SC DoR SC 990-T online.

- Use the ‘Get Form’ button to access the SC DoR SC 990-T online form and open it for completion.

- Begin by entering your taxpayer identification information. Include the SC file number and FEIN, and provide the organization's name and mailing address, ensuring accurate contact details.

- Indicate the type of return you are filing by checking the appropriate boxes for 'Initial Return' or 'Amended Return.' If applicable, indicate whether this is a final return and specify the county or counties in South Carolina where the property is located.

- Fill out the income tax period ending date. Follow this by entering the federal unrelated business taxable income from your federally filed Form 990-T.

- Complete line 2 with any net adjustments as applicable, and then compute the total net income to reconcile on line 3.

- If you are a multi-state organization, enter the corresponding amount from line 6 of Schedule G; otherwise, replicate the total from line 3.

- If applicable, subtract any South Carolina net operating loss carryover from the total net income on line 5. The tax amount due is then calculated by multiplying the net income subject to tax by 5%.

- Report any non-refundable credits on line 8 and compute the balance of tax due by subtracting total payments from balance on line 9.

- Proceed to detail any payments made, including any amounts withheld and payments made with tentative returns.

- Finalize your return by ensuring that the declaration is signed by an authorized officer, providing all necessary information about the preparer if applicable.

- Review all filled data for accuracy. Save changes, download a copy of the filled form, print it or share as required for submission.

Ensure timely submission of your documents online to meet filing deadlines.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Any tax-exempt organization that generates unrelated business income is required to file Form 990-T. This applies regardless of whether the organization is a larger charity or a small non-profit. To remain compliant, regularly consult the SC DoR SC 990-T guidelines and seek assistance through tools like US Legal Forms for easy filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.