Loading

Get Sc Dor Pt-401 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR PT-401 online

Filling out the SC DoR PT-401 application for exemption can be a straightforward process when approached step by step. This guide aims to provide you with clear and concise instructions to successfully complete the form online.

Follow the steps to complete the SC DoR PT-401 application online.

- Click the ‘Get Form’ button to access the application and open it in the editor.

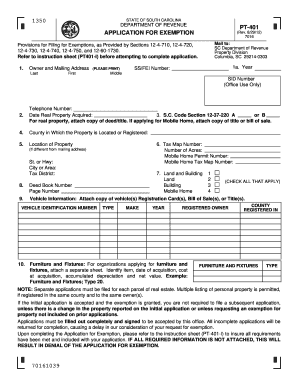

- Provide the owner and mailing address details at the top of the form. Ensure you fill in your last name, first name, middle name, and the year of the application. Include your Social Security or Federal Employer Identification number, and the SID number, if applicable.

- Input your telephone number and the date when you acquired the real property.

- Identify the specific South Carolina Code Section under which you are applying for exemption. If necessary, attach a copy of the deed or title for real property or a bill of sale for a mobile home.

- Specify the county in which the property is located or registered.

- Fill out the location of the property, including the street or highway name, city or area, and tax district.

- For tax purposes, enter the tax map number, number of acres, mobile home permit number, and mobile home tax map number if applicable.

- Select the applicable types of land and buildings by checking all that apply for land, buildings, or mobile homes.

- Complete the deed book number and page number if relevant.

- If applicable, provide vehicle information by attaching a copy of the vehicle registration cards, bills of sale, or titles. Fill in details like vehicle identification number, type, make, year, and registered owner.

- For organizations applying for furniture and fixtures, attach a separate sheet listing the items, acquisition dates, costs, accrued depreciation, and net values.

- Answer the questions regarding organization incorporation status, tax exemption status, previous returns filed, occupation of the property by others, rental income received, and any limitations or restrictions concerning property use.

- After ensuring all fields are filled out completely, sign the declaration section as the owner or owner's agent, and add the date.

- Review the form thoroughly for completion and accuracy. Save your changes, and consider downloading, printing, or sharing the form as needed.

Start completing your SC DoR PT-401 application online today!

Related links form

The PT-401 is a form used in South Carolina to apply for property tax exemptions specifically for seniors, the disabled, and veterans. It plays a crucial role in helping eligible individuals reduce their tax burden. Filing the SC DoR PT-401 correctly can lead to significant financial relief. Be sure to provide accurate information to maximize your benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.