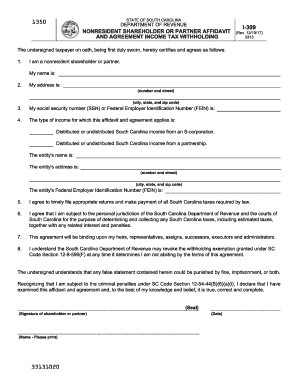

Get Sc Dor I-309 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign SC DoR I-309 online

How to fill out and sign SC DoR I-309 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can become a considerable obstacle and significant nuisance if insufficient assistance is provided. US Legal Forms has been developed as an online solution for SC DoR I-309 e-filing and offers numerous advantages for taxpayers.

Utilize the guidelines on how to complete the SC DoR I-309:

Utilize US Legal Forms to ensure an easy and straightforward SC DoR I-309 completion.

- Locate the template on the website within the designated section or through the Search feature.

- Click the orange button to access it and wait until it is fully loaded.

- Examine the form and pay attention to the guidance. If you have never completed the template previously, adhere to the line-by-line instructions.

- Pay attention to the highlighted fields. These are editable and require specific information to be input. If uncertain about what details to include, refer to the instructions.

- Always sign the SC DoR I-309. Utilize the built-in tool to create the e-signature.

- Select the date field to automatically insert the correct date.

- Review the sample to verify and modify it prior to e-filing.

- Click the Done button in the upper menu once you have completed it.

- Save, download, or export the finished form.

How to Modify Get SC DoR I-309 2017: Personalize Forms Online

Your easily adjustable and adaptable Get SC DoR I-309 2017 template is readily accessible.

Do you delay preparing Get SC DoR I-309 2017 because you merely don't know how to begin and proceed? We recognize your sentiments and possess an outstanding resolution for you that has absolutely nothing to do with overcoming your delays!

Our online selection of ready-to-modify templates permits you to browse and choose from countless fillable forms tailored for a variety of objectives and scenarios. Yet, obtaining the document is just the beginning. We provide you with all the necessary features to complete, certify, and modify the template of your preference without leaving our platform.

All you need to do is access the template in the editor. Review the wording of Get SC DoR I-309 2017 and verify if it's what you’re searching for. Begin filling out the form by utilizing the annotation features to give your document a more structured and tidier appearance.

In summary, along with Get SC DoR I-309 2017, you'll receive:

Compliance with eSignature regulations governing the use of eSignature in online transactions.

With our professional service, your finished documents are always legally enforceable and fully encrypted. We are committed to protecting your most sensitive information. Obtain everything necessary to create a professional-looking Get SC DoR I-309 2017. Make an excellent decision and try our service now!

- Add checkmarks, circles, arrows, and lines.

- Highlight, blackout, and amend the existing text.

- If the template is designed for others as well, you can incorporate fillable fields and distribute them for other participants to complete.

- Once you've finished filling out the template, you can obtain the document in any available format or select any sharing or delivery methods.

- A comprehensive suite of editing and annotation tools.

- A built-in legally-binding eSignature function.

- The capability to generate documents from scratch or based on the pre-prepared template.

- Compatibility with various platforms and devices for enhanced convenience.

- Multiple options for safeguarding your documents.

- A variety of delivery methods for easier sharing and sending files.

Get form

Choosing between 1 or 0 allowances depends on your individual tax situation and financial goals. Claiming '0' usually results in higher withholdings and may help avoid a tax bill, while '1' gives you a larger paycheck but could lead to owing taxes later. Use the SC DoR I-309 to evaluate which option aligns best with your future financial plans.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.