Loading

Get Sc Dor I-295 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR I-295 online

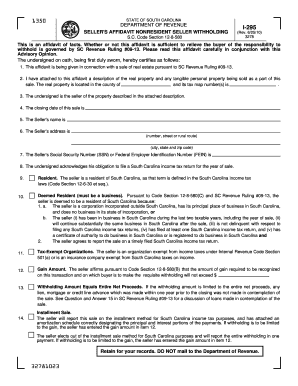

Filling out the SC DoR I-295 form online is a straightforward process that enables sellers to provide essential information for real estate transactions. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the SC DoR I-295 form online.

- Use the ‘Get Form’ button to obtain the SC DoR I-295 form and open it in your preferred digital editor.

- Begin with section 1, where you need to certify that the affidavit is being provided in connection with a sale of real estate. Ensure you reference SC Revenue Ruling #09-13.

- In section 2, attach a description of the real property and any tangible personal property being sold. Include the county and tax map number(s) associated with the property.

- Provide the closing date of the sale in section 4.

- Input the seller's name in section 5 and their address in section 6, ensuring you include the complete address details.

- In section 7, enter the seller's Social Security Number (SSN) or Federal Employer Identification Number (FEIN).

- Acknowledge your obligation to file a South Carolina income tax return for the year of sale in section 8.

- Choose between indicating residency in section 9 or, if applicable, providing the required information for deemed residents in section 10.

- If tax-exempt, complete section 11 by providing details about the tax-exempt organization.

- Declare the gain amount in section 12, ensuring that the reported amount aligns with the requirements under SC Code Section 12-8-580(B).

- Complete sections 13 through 17 as applicable to your situation, choosing the correct statements regarding withholding amounts and exemptions.

- In the last step, ensure all details are correctly filled, then save your changes, and consider downloading, printing, or sharing the form as needed.

Begin completing your SC DoR I-295 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out the SC W-4 form, begin by entering your personal information, including your name, address, and Social Security number. Next, indicate your filing status and the number of allowances you wish to claim, considering your family and financial situation. For clear directions and up-to-date tax guidance, refer to the SC DoR I-295, which can assist you through the process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.