Get Sc Dor Fs-102 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR FS-102 online

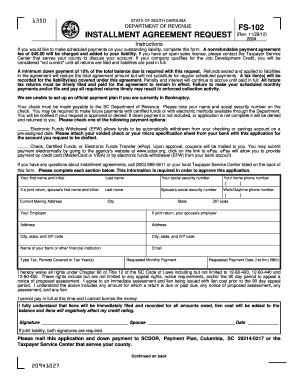

Filling out the SC DoR FS-102 form for an installment agreement request is an important step in managing your tax liabilities. This guide will provide you with a clear, step-by-step process to complete the form online, ensuring that you understand each section and field along the way.

Follow the steps to successfully complete the SC DoR FS-102 online.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Fill in your first name, middle initial, and last name. Make sure to provide your correct social security number. Enter your home phone number for further communication.

- If you are filing a joint return, include your spouse's first name, middle initial, last name, and their social security number. Also, provide your spouse's work or daytime phone number.

- Complete the current mailing address section, including the city, state, and ZIP code. Ensure that the information is accurate to avoid delays.

- Next, provide the name and address of your employer. If applicable, include your spouse's employer information as well.

- Indicate your bank's name or financial institution and provide your email address for communication regarding your installment agreement.

- Specify the type of tax, periods covered or the tax year(s) that your request pertains to. Additionally, include the monthly payment you are requesting and the preferred payment date.

- Review the waiver section and ensure you understand the implications of waiving rights under Chapter 60 of Title 12 of the SC Code of Laws. Confirm your understanding by signing the form along with your spouse, if applicable.

- If you are opting for Electronic Funds Withdrawal (EFW), include your bank account information, including routing transit and account numbers. Attach a voided check or micro specification sheet as required.

- Last, review all information entered for accuracy. Save the changes, download a copy for your records, and print the completed form. You can also share it as necessary.

Complete your SC DoR FS-102 form online today to establish your installment agreement and manage your tax liabilities effectively.

Get form

Garnishment by the SC Department of Revenue occurs when the state withholds a portion of your income to satisfy tax debts. This legal action typically happens after you receive notices and do not respond to resolve your tax obligations. The SC DoR FS-102 outlines the procedures involved and your rights during this process. If you face garnishment and need help, UsLegalForms offers tools to navigate these challenging situations effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.