Loading

Get Ri Tx-17 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI TX-17 online

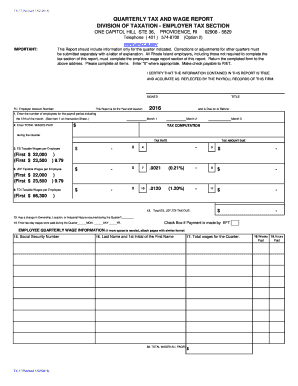

The RI TX-17 is a vital form for employers in Rhode Island that allows for the reporting of quarterly tax and wage information. This guide will walk you through the essential steps to complete the form online, ensuring that you provide accurate and necessary information.

Follow the steps to successfully complete your RI TX-17 form online.

- Use the 'Get Form' button to access the RI TX-17 and open the document for completion.

- Indicate the quarter for which you are reporting by filling in the respective year and quarter. Ensure that this is accurate as it affects the calculations.

- Enter the total number of employees for each month within the quarter. This should include both full-time and part-time employees who were active during the payroll period that includes the 12th of the month.

- Report the total wages paid during the quarter for each month. Make sure that this figure encompasses all forms of compensation provided to employees.

- Calculate the Employment Security taxable wages for each employee as per the guidelines. You will need to multiply the taxable wage amount by the respective tax rates provided in the form.

- Complete the Job Development Fund and Temporary Disability Insurance tax computations following the directions in the form. Ensure you respect the wage bases for each tax category.

- Fill out the section regarding changes in ownership or location, if applicable. This requires a simple yes or no response, with further explanation as needed.

- Provide the last date wages were paid during the quarter, entering all details as specified.

- Complete the employee wage information section by entering each employee's Social Security number, last name, first initial, total wages, weeks paid, and hours paid. Be meticulous to ensure accuracy.

- Review all entries to ensure there are no errors, providing clear entries and appropriate zeros where required. When completed, save the document securely.

- Once you have reviewed the completed form, you can choose to save changes, download, print, or share the document as needed.

Complete your RI TX-17 form online today to ensure compliance with tax reporting requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Rhode Island disability tax is part of the state’s effort to provide financial assistance to individuals suffering temporary disabilities. This tax funds the SDI program, which offers critical support to eligible employees. Being familiar with the RI TX-17 will allow you to understand how your contributions are calculated and what benefits they provide.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.