Loading

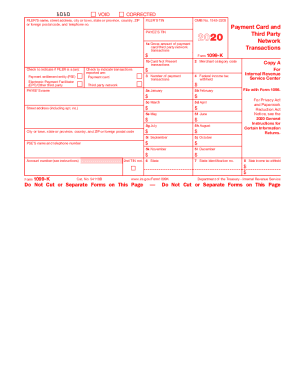

Get Irs 1099-k 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-K online

Filling out the IRS 1099-K form correctly is essential for anyone receiving payment card or third-party network transactions exceeding certain thresholds. This guide will walk you through the necessary steps to complete the form online, ensuring you meet all requirements accurately.

Follow the steps to accurately fill out the IRS 1099-K form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the FILER’s name, address, and telephone number in the designated fields. This information identifies who is reporting the payments.

- Fill in the FILER’S TIN (Tax Identification Number) to ensure correct identification of the reporting entity.

- Input the PAYEE’S TIN in the appropriate section to identify the recipient of the reported payment amounts.

- In Box 1a, enter the gross amount of payment card or third-party network transactions made to the payee during the calendar year.

- If applicable, check Box 1b to indicate if any card-not-present transactions occurred, usually for online or phone sales.

- Complete Box 2 by entering the merchant category code, if available, to specify the nature of the transactions.

- Input the number of payment transactions in Box 3, excluding refunds, to quantify the transactions processed.

- Fill out Box 4 for any federal income tax withheld. This indicates if any backup withholding applies due to missing or incorrect TIN.

- For each month from January to December, enter the gross amounts in Boxes 5a through 5l to provide a monthly breakdown of transactions.

- If applicable, fill in Boxes 6 to 8 for state information, including state income tax withheld, to meet any state requirements.

- Once all relevant sections are completed, save your changes, and prepare to download, print, or share the form as needed.

Ensure you complete your IRS 1099-K form online to meet all filing requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you must report a 1099-K on your taxes if it reflects income received from payment processing or other services. The IRS uses this information to verify your reported income, so it's crucial to include it. Using platforms like uslegalforms can help you understand how to report this income accurately and navigate your tax responsibilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.