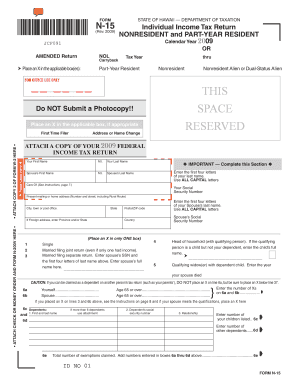

Get Hi N-15 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign HI N-15 online

How to fill out and sign HI N-15 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Selecting a legal professional, scheduling an appointment, and visiting the office for a confidential meeting makes completing a HI N-15 from start to finish tiring.

US Legal Forms allows you to quickly generate legally binding documents based on pre-existing web forms.

Quickly create a HI N-15 without needing to consult specialists. Over 3 million customers are already taking advantage of our extensive range of legal documents. Join us today to gain access to the premier collection of web-based templates. Experience it for yourself!

- Obtain the HI N-15 you require.

- Access it with a cloud-based editor and begin modifying.

- Complete the empty fields; involved parties' names, addresses, and contact numbers, etc.

- Tailor the fields with intelligent fillable options.

- Add the date and affix your electronic signature.

- Click on Done after double-checking all details.

- Store the finalized documents on your device or print it out as a physical copy.

How to alter Get HI N-15 2009: personalize forms online

Handling documents is effortless with intelligent online tools. Remove paperwork with easily accessible Get HI N-15 2009 templates you can adjust online and print.

Creating papers and documents should be more attainable, whether it’s a regular aspect of one’s job or infrequent work. When someone has to submit a Get HI N-15 2009, exploring rules and guides on how to accurately fill out a form and what it should contain may demand considerable time and effort. However, if you find the appropriate Get HI N-15 2009 template, completing a document will cease to be a challenge with a smart editor at your disposal.

Uncover a wider array of features you can incorporate into your document workflow routine. No need to print, fill in, and annotate forms by hand. With a smart editing platform, all essential document processing features are always available. If you aim to enhance your workflow with Get HI N-15 2009 forms, locate the template in the catalog, select it, and find a simpler approach to complete it.

The more tools you are accustomed to, the easier it is to manage Get HI N-15 2009. Experiment with the solution that provides everything necessary to locate and modify forms within a single browser tab and eliminate manual paperwork.

- If you want to insert text in a random section of the form or add a text field, utilize the Text and Text field tools and expand the text in the form as much as you desire.

- Use the Highlight tool to emphasize the critical parts of the form. If you wish to obscure or erase certain text sections, apply the Blackout or Erase tools.

- Personalize the form by adding default graphical elements to it. Use the Circle, Check, and Cross tools to incorporate these components into the forms, if feasible.

- If you require additional notes, use the Sticky note feature and add as many notes on the forms page as necessary.

- If the form requires your initials or date, the editor has tools for that as well. Minimize the likelihood of errors by utilizing the Initials and Date instruments.

- It’s also simple to add unique visual elements to the form. Use the Arrow, Line, and Draw tools to customize the document.

Get form

Tourists cannot typically claim a tax refund on their purchases while in Hawaii. However, most non-residents who earn income in Hawaii can utilize the HI N-15 form to claim any applicable refunds for taxes withheld. It is worth understanding your tax obligations to maximize potential savings.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.