Get Ri Dot Ri-1040nr 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI DoT RI-1040NR online

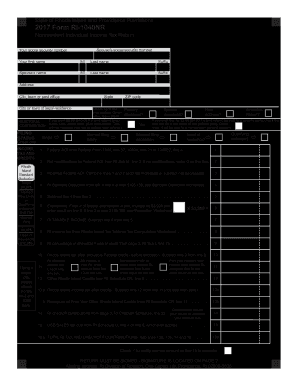

Filling out the RI DoT RI-1040NR form online can seem challenging, but with this comprehensive guide, you will be equipped with all the necessary steps to complete your nonresident individual income tax return efficiently. This user-friendly guide aims to assist you in navigating through each section of the form with confidence.

Follow the steps to complete your RI DoT RI-1040NR online.

- Click ‘Get Form’ button to access the RI DoT RI-1040NR form and open it in the editing tool.

- Begin by filling in your personal information, including your name, social security number, and address. If applicable, also include your spouse’s details.

- Select your filing status by checking the appropriate box that applies to you or your spouse. Options include single, married filing jointly, or head of household.

- Report your federal adjusted gross income (AGI) on line 1. This is found on your federal tax form (1040, 1040A, or 1040EZ).

- Enter any net modifications to your federal AGI on line 2. If there are no modifications, input 0.

- Calculate your modified federal AGI on line 3 by adding or subtracting the amounts from lines 1 and 2.

- On line 4, refer to the Rhode Island standard deduction applicable to your filing status and enter that amount.

- Subtract line 4 from line 3 and enter the result on line 5, which will be your taxable income.

- Enter the Rhode Island income tax calculated based on your taxable income on line 8.

- Complete the necessary schedules for any federal credits and deductions, then enter the results on the relevant lines.

- Review all fields to ensure accuracy, then save your changes, and choose to download, print, or share your completed form.

Complete your RI DoT RI-1040NR online to ensure timely and accurate filing.

Get form

Individuals who earn income in Rhode Island must file a RI tax return. This includes residents, non-residents, and part-year residents. Those who meet the income thresholds established by the Rhode Island Division of Taxation, or those who need to claim a refund, are required to submit a RI DoT RI-1040NR. Filing correctly ensures compliance with state tax laws and avoids potential penalties.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.