Loading

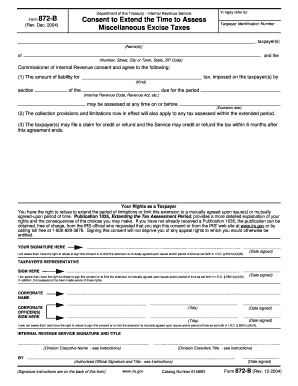

Get Irs 872-b 2004-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 872-B online

Filling out the IRS 872-B form is a necessary step for taxpayers who wish to extend the time to assess miscellaneous excise taxes. This guide offers clear, step-by-step instructions to assist you in completing the form online.

Follow the steps to complete the IRS 872-B form online.

- Press the ‘Get Form’ button to acquire the IRS 872-B form and open it in your preferred editing interface.

- Enter the taxpayer identification number of the taxpayer(s) in the corresponding field.

- Fill in the name(s) of the taxpayer(s) in the designated area.

- Provide the complete address of the taxpayer(s), including number, street, city or town, state, and ZIP code.

- Indicate the specific type of tax imposed on the taxpayer(s) by completing the appropriate field.

- Specify the section of the Internal Revenue Code applicable to the tax due.

- Fill in the expiration date for the consent to extend the time to assess taxes.

- Review all filled information for accuracy and completeness.

- Finalize your completion by downloading, printing, or sharing the form as needed.

Take the next step and complete your IRS 872-B form online today.

The effectively connected income statute defines how certain foreign earnings are taxed within the United States. This statute determines how income is treated for tax purposes, especially for non-resident foreigners. Knowledge of this statute can be crucial when considering IRS 872-B options, ensuring that you comply with U.S. tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.