Loading

Get Or Or-cppr 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR OR-CPPR online

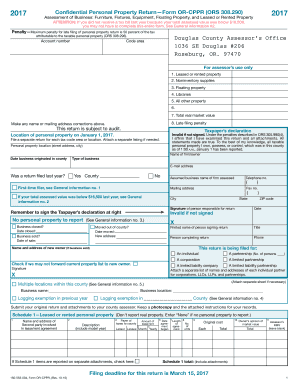

The OR OR-CPPR is a crucial form for reporting personal property for tax purposes in Oregon. This guide provides a detailed overview and step-by-step instructions on how to complete the form efficiently and accurately, ensuring compliance with necessary regulations.

Follow the steps to successfully complete your OR OR-CPPR form online.

- Click ‘Get Form’ button to access the form and open it in your preferred online platform.

- Begin by entering your account number at the top of the form. This number is essential for properly identifying your tax account and ensuring accurate processing.

- Provide your name, mailing address, and any corrections needed to ensure accurate communication with the Douglas County Assessor's Office.

- Complete the section regarding your property's location as of January 1 of the reporting year. Include the street address, city, and state.

- Indicate whether you filed a return last year. If yes, specify the county where the return was filed.

- Fill out the sections for leased or rented property, noninventory supplies, floating property, and all other taxable personal property as applicable. Make sure to follow any specific instructions for each schedule.

- Sign the taxpayer’s declaration. Ensure that the declaration is signed by a responsible person, affirming that all provided information is accurate.

- Review your completed form for accuracy. Once confirmed, you can submit your original return and any attachments to the Douglas County Assessor's Office online.

- After submission, save changes to your records, and consider downloading or printing a copy of your completed form for your reference.

Complete your OR OR-CPPR form online to ensure compliance and avoid penalties today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Several factors contribute to the property tax levels in Oregon, including local funding needs and the reliance on property taxes for essential services. Also, property assessments can vary, leading to higher taxes for certain areas. For a clearer picture of how OR OR-CPPR affects your tax status, consult informative resources or services available through uslegalforms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.