Get Pr Sc 2644 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR SC 2644 online

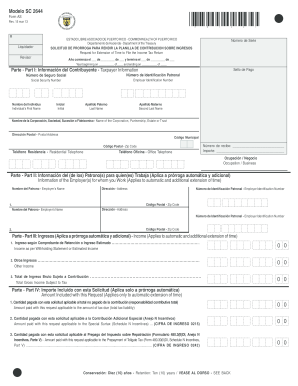

The PR SC 2644 is an essential form for individuals and businesses seeking an extension of time to file their income tax returns in Puerto Rico. This guide will provide clear and detailed instructions to assist you in completing this form accurately and efficiently online.

Follow the steps to complete the PR SC 2644 online.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Enter the taxable year at the top by filling in the start and end dates for the period you are requesting the extension for.

- In Part I, fill in your personal information, including your full name, postal address, and social security or employer identification number. Ensure all details are accurate.

- If you are employed, provide the details of your employer(s) in Part II, including their name, address, and identification number.

- Proceed to Part III to report your income. Enter your income as per your withholding statement or provide an estimate of your earnings. Include any additional income you may have.

- In Part IV, indicate the amount included with your request for the tax due. This is essential for processing your extension.

- Review all entries for accuracy and completeness. Ensure that all required fields are completed.

- Save your form, download it, or print it for submission. Follow any final instructions for filing with the Department of the Treasury.

Complete your PR SC 2644 form online today for a seamless extension process!

Get form

TurboTax allows users to easily prepare their Puerto Rico tax returns, including the PR SC 2644 form. This platform provides tools and resources tailored to Puerto Rican taxpayers, ensuring a smooth filing process. By utilizing TurboTax, you can efficiently manage your tax obligations and ensure compliance with local laws. Enjoy the benefits of a user-friendly interface while tackling your Puerto Rico taxes.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.