Loading

Get Pr Sc 2644 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR SC 2644 online

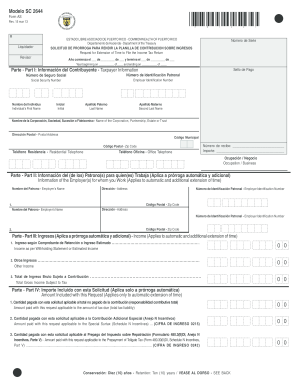

This guide provides a clear and supportive framework for completing the PR SC 2644 form, which is the request for an extension of time to file the income tax return in Puerto Rico. Whether you're a new user or have filled out tax forms before, this step-by-step instruction will help you navigate the online process with ease.

Follow the steps to successfully complete the PR SC 2644.

- Press the ‘Get Form’ button to access the form. After obtaining the document, open it in the preferred online editor.

- Enter the taxable year by filling in the beginning and ending dates of the year for which you are requesting the extension.

- In Part I, provide your complete taxpayer information including your name, postal address, social security number (if applicable), and employer identification number.

- In Part II, if you are an employee, include the information of your employer(s), such as their names, addresses, and identification numbers.

- Move to Part III to report your income. Enter your income according to your withholding statement or provide an estimated income if you do not have the statement.

- Include any other income gained in the year if you are self-employed. Calculate your total gross income subject to tax by summing all relevant income entries.

- For Part IV, indicate any amount you are including with this request, such as payments applicable to any tax due, using separate checks as needed.

- In Part V, select your correct taxpayer class by checking the appropriate box. This classification must be accurate for the extension to be processed.

- In Part VI, if applicable, request any additional extensions you may need by filling out the required information, particularly if you are outside Puerto Rico.

- Finally, complete the oath section, ensuring to sign and date the form. Review all fields for accuracy before submission.

- Once completed, save your changes, download the form, and choose to print or share it as necessary to finalize your submission.

Complete your PR SC 2644 form online today to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can file a tax extension online through various platforms, including the IRS website. Ensure that this filing includes compliance with Puerto Rican tax laws relevant to PR SC 2644. For ease and accuracy, you might want to use online services found on uslegalforms, which offer supportive features to assist in this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.