Loading

Get Pr Modelo Sc 6042 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR Modelo SC 6042 online

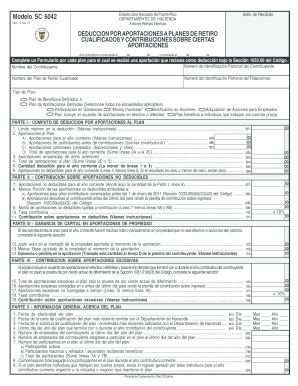

Filling out the PR Modelo SC 6042 is a crucial step for users wishing to claim deductions for contributions to qualified retirement plans in Puerto Rico. This guide provides clear, step-by-step instructions to assist you in completing the form correctly and easily.

Follow the steps to fill out the PR Modelo SC 6042 with confidence.

- Press the ‘Get Form’ button to access the form, opening it in your preferred digital editor.

- In the initial section, input the contributive year by specifying the start and end dates clearly.

- Provide the name and employer identification number of the taxpayer who is claiming the deduction.

- Indicate the name of the qualified retirement plan and the trust's employer identification number.

- Select the type of plan by checking all applicable boxes, including whether it includes cash or deferred contributions, and if it benefits self-employed individuals.

- In Part I, calculate the deductions for contributions by filling out the limits and totals, following the line instructions carefully.

- Move to Part II if you need to report on non-deductible contributions, and fill out the entire section as required based on the previous calculations.

- In Part III, if applicable, provide details regarding property contributions and determine any capital gain or loss from these contributions.

- Complete Part IV if there were excessive contributions, ensuring that you denote any contributions corrected before the deadline.

- Finally, complete Part V with general information about the plan, confirming all employee and compensation details accurately.

- Once all sections are filled, save your changes, and choose your option to download, print, or share the form as needed.

Start filling out your PR Modelo SC 6042 online to maximize your deductions today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The IVU Lotto in Puerto Rico is an initiative aimed at promoting compliance with tax obligations among businesses. It encourages consumers to request receipts, which helps track sales. Learning about this initiative, alongside the PR Modelo SC 6042, can be beneficial for understanding your responsibilities as a taxpayer.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.