Loading

Get Pr Form 499 R-4.1 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR Form 499 R-4.1 online

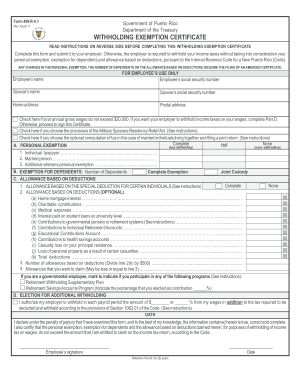

Filling out the PR Form 499 R-4.1, also known as the withholding exemption certificate, is an essential step to ensure appropriate income tax withholding from your wages. This guide provides clear, step-by-step instructions to help you complete this form accurately online.

Follow the steps to accurately complete the PR Form 499 R-4.1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the upper section of the form with your name, social security number, home address, and postal address. Ensure that all information is accurate and legible.

- If your annual gross wages do not exceed $20,000, check the applicable box. If you wish for your employer to withhold taxes on your wages, complete Part D of the form.

- Indicate whether you choose the provisions of the Military Spouses Residency Relief Act, or if you wish to opt for the optional computation for married individuals living together, marking the appropriate boxes.

- In Part A, select options regarding your personal exemption. Mark the column that best represents your situation: Individual taxpayer, married person, or veteran’s exemption.

- For Part B, indicate the number of dependents you claim. If applicable, specify the children for which you have joint custody.

- In Part C, provide details regarding deductions. Enter the estimated amounts for various potential deductions and calculate the total allowances.

- In Part D, if you wish to authorize additional withholding, specify the amount or percentage you want deducted from each paycheck.

- Review all information provided on the form for accuracy. Once confirmed, sign and date the certificate in the designated area.

- Save your changes, and download or print the completed form for submission to your employer.

Complete your PR Form 499 R-4.1 online today to ensure your income taxes are accurately withheld.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Deciding whether to claim 0 or 1 on your W4 depends on your individual tax situation, including your income and filing status. Claiming 0 typically results in more tax withheld, while claiming 1 may reduce your withheld amount. To make the best choice, you can refer to the PR Form 499 R-4.1 and consider your financial goals for the year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.