Loading

Get Pr Form 499 R-4.1 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR Form 499 R-4.1 online

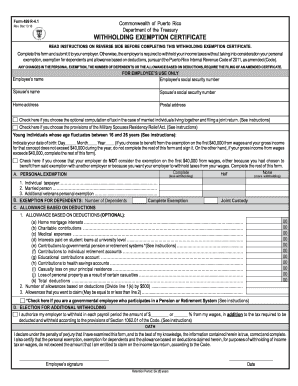

This guide provides you with a clear and concise walkthrough for completing the PR Form 499 R-4.1 online, known as the Withholding Exemption Certificate. Following these steps will ensure that you accurately submit the necessary information to your employer, thereby determining the appropriate withholding of income taxes from your wages.

Follow the steps to fill out the PR Form 499 R-4.1 online.

- Press the 'Get Form' button to access the PR Form 499 R-4.1 and open it in the online editor.

- Fill in the upper section with your personal details, including your name, social security number, home address, and postal address. If married, include your spouse’s information as well.

- Indicate whether you choose the optional computation of tax for married individuals filing jointly by checking the appropriate box.

- If you are a young individual aged between 16 and 26 and wish to claim an exemption on the first $40,000 of gross income, indicate your date of birth. If your income exceeds this amount, complete the rest of the form.

- In Part A, select your personal exemption by checking the corresponding box for 'Complete', 'None', or 'Half' based on your situation.

- In Part B, indicate the number of dependents you wish to claim, consistent with your income tax return, and specify any children for whom you have joint custody.

- In Part C, list any allowances based on deductions you wish to claim. This includes various categories like home mortgage interests and charitable contributions.

- For Part D, if you wish to withhold an additional amount from your wages, specify the dollar amount or percentage in the provided space.

- Review all entered information for accuracy. Once confirmed, sign and date the form in the Oath section.

- After completing the form, save changes, and choose to download, print, or share the form as needed.

Complete your PR Form 499 R-4.1 online today to ensure your income taxes are correctly withheld.

Deciding whether to claim 0 or 1 on your W4 form depends on your tax situation and personal preferences. Claiming 0 will typically result in more tax being withheld, while claiming 1 may reduce your withholding. Use the PR Form 499 R-4.1 as a resource to evaluate your choices and make an informed decision.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.