Loading

Get Sc Sc3911 1995-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC SC3911 online

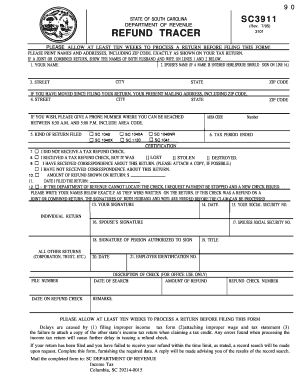

The SC SC3911 is a refund tracer form used in South Carolina to inquire about tax refunds. This guide provides detailed instructions on how to fill out the form effectively to ensure your request is processed smoothly.

Follow the steps to complete the SC SC3911 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in line 1 of the form exactly as it appears on your tax return. If you filed a joint return, enter your partner's name on line 2.

- Fill in your current mailing address in the fields provided, ensuring to include your street, city, state, and zip code. If you have moved since filing your return, do not forget to update your address.

- Provide a phone number where you can be reached during business hours, including your area code.

- Indicate the kind of return you filed by checking the appropriate box.

- Fill in the tax period ended date relevant to your refund.

- Choose the reason for your refund request by selecting from the options provided: lost, stolen, or destroyed.

- If you have received any correspondence related to your return, indicate this on the form and attach the copy if available. If you have not received any correspondence, simply check the corresponding box.

- Enter the amount of refund shown on your tax return.

- Fill in the date when you filed the return.

- Provide your signature and the date on lines 13 and 14. If applicable, obtain your partner's signature on line 16.

- Enter your social security number on line 15 and your partner's social security number on line 17 if applicable.

- If someone is authorized to sign on behalf of another return type, ensure that their information is filled out in sections 18-21, including signature, title, and employer identification number.

- Review the completed form for any errors, and then save your changes. You can download, print, or share the form as needed.

Complete your SC SC3911 form online to initiate your refund tracing process today.

Yes, South Carolina does impose a corporate state income tax on businesses operating within the state. The current rate is based on taxable income as defined by state law. Understanding your obligations, especially when using forms like SC SC3911, can help you stay compliant and manage your business finances effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.